Page 167 - Capricorn IAR 2020

P. 167

for the year ended 30 June 2020

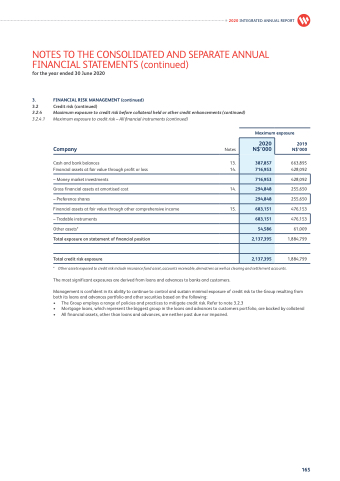

3. FINANCIAL RISK MANAGEMENT (continued)

3.2 Credit risk (continued)

3.2.4 Maximum exposure to credit risk before collateral held or other credit enhancements (continued)

3.2.4.1 Maximum exposure to credit risk – All financial instruments (continued)

Company Notes

Maximum exposure

2020 INTEGRATED ANNUAL REPORT

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

2020 N$’000

Cash and bank balances

Financial assets at fair value through profit or loss

– Money market investments

Gross financial assets at amortised cost

– Preference shares

Financial assets at fair value through other comprehensive income – Tradable instruments

Other assets*

Total exposure on statement of financial position

Total credit risk exposure

13. 14.

14. 15.

2019 N$’000

663,895 428,092

255,650

476,153

61,009 1,884,799

1,884,799

387,857

716,953

716,953

294,848

428,092

294,848

255,650

683,151

683,151

476,153

54,586

2,137,395

2,137,395

* Other assets exposed to credit risk include insurance fund asset, accounts receivable, derivatives as well as clearing and settlement accounts.

The most significant exposures are derived from loans and advances to banks and customers.

Management is confident in its ability to continue to control and sustain minimal exposure of credit risk to the Group resulting from both its loans and advances portfolio and other securities based on the following:

• The Group employs a range of policies and practices to mitigate credit risk. Refer to note 3.2.3

• Mortgage loans, which represent the biggest group in the loans and advances to customers portfolio, are backed by collateral

• All financial assets, other than loans and advances, are neither past due nor impaired.

165