Page 170 - Capricorn IAR 2020

P. 170

GLOSSARY OF TERMS ANNUAL FINANCIAL GLOSSARY OF TERMS STATEMENTS

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

3. FINANCIAL RISK MANAGEMENT (continued)

3.2 Credit risk (continued)

3.2.5 Risk limit control and mitigation policies (continued)

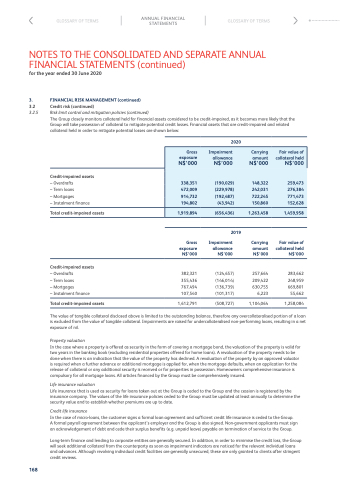

The Group closely monitors collateral held for financial assets considered to be credit-impaired, as it becomes more likely that the Group will take possession of collateral to mitigate potential credit losses. Financial assets that are credit-impaired and related collateral held in order to mitigate potential losses are shown below:

2020

Gross exposure N$’000

Impairment allowance N$’000

Carrying amount N$’000

Fair value of collateral held N$’000

338,351

(190,029)

148,322

259,473

472,009

(229,978)

242,031

276,384

914,732

(192,487)

722,245

771,473

194,802

(43,942)

150,860

152,628

1,919,894

(656,436)

1,263,458

1,459,958

Credit-impaired assets

– Overdrafts

– Term loans

– Mortgages

– Instalment finance

Total credit-impaired assets

Credit-impaired assets

– Overdrafts

– Term loans

– Mortgages

– Instalment finance

Total credit-impaired assets

2019

Gross Impairment exposure allowance N$’000 N$’000

Carrying amount N$’000

Fair value of collateral held N$’000

283,662 248,959 669,801

55,662

1,258,084

382,321 (124,657) 257,664 355,436 (146,014) 209,422 767,494 (136,739) 630,755 107,540 (101,317) 6,223

1,612,791 (508,727) 1,104,064

168

The value of tangible collateral disclosed above is limited to the outstanding balance, therefore any overcollateralised portion of a loan is excluded from the value of tangible collateral. Impairments are raised for undercollateralised non-performing loans, resulting in a net exposure of nil.

Property valuation

In the case where a property is offered as security in the form of covering a mortgage bond, the valuation of the property is valid for two years in the banking book (excluding residential properties offered for home loans). A revaluation of the property needs to be done when there is an indication that the value of the property has declined. A revaluation of the property by an approved valuator is required when a further advance or additional mortgage is applied for, when the mortgage defaults, when an application for the release of collateral or any additional security is received or for properties in possession. Homeowners comprehensive insurance is compulsory for all mortgage loans. All articles financed by the Group must be comprehensively insured.

Life insurance valuation

Life insurance that is used as security for loans taken out at the Group is ceded to the Group and the cession is registered by the insurance company. The values of the life insurance policies ceded to the Group must be updated at least annually to determine the security value and to establish whether premiums are up to date.

Credit life insurance

In the case of micro-loans, the customer signs a formal loan agreement and sufficient credit life insurance is ceded to the Group.

A formal payroll agreement between the applicant’s employer and the Group is also signed. Non-government applicants must sign an acknowledgement of debt and cede their surplus benefits (e.g. unpaid leave) payable on termination of service to the Group.

Long-term finance and lending to corporate entities are generally secured. In addition, in order to minimise the credit loss, the Group will seek additional collateral from the counterparty as soon as impairment indicators are noticed for the relevant individual loans and advances. Although revolving individual credit facilities are generally unsecured, these are only granted to clients after stringent credit reviews.