Page 183 - Capricorn IAR 2020

P. 183

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

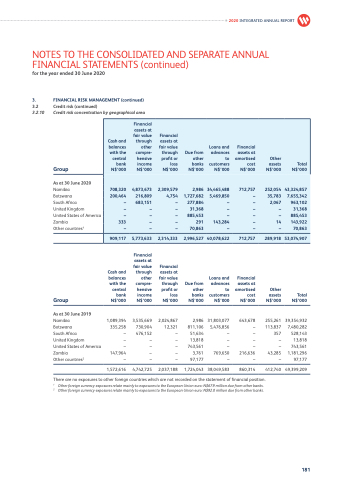

3. FINANCIAL RISK MANAGEMENT (continued)

3.2 Credit risk (continued)

3.2.10 Credit risk concentration by geographical area

2020 INTEGRATED ANNUAL REPORT

Cash and balances with the central bank N$’000

Financial assets at fair value through other compre- hensive income N$’000

Financial assets at fair value through profit or loss N$’000

Due from other banks N$’000

Loans and advances to customers N$’000

Financial

assets at amortised cost N$’000

Other assets N$’000

Total N$’000

708,320

4,873,673

2,309,579

2,986

34,465,488

712,757

252,054

43,324,857

200,464

216,809

4,754

1,727,682

5,469,850

–

35,783

7,655,342

–

683,151

–

277,884

–

–

2,067

963,102

–

–

–

31,368

–

–

–

31,368

–

–

–

885,453

–

–

–

885,453

333

–

–

291

143,284

–

14

143,922

–

–

–

70,863

–

–

–

70,863

909,117

5,773,633

2,314,333

2,996,527

40,078,622

712,757

289,918

53,074,907

Group

As at 30 June 2020

Namibia

Botswana

South Africa

United Kingdom

United States of America Zambia

Other countries1

Cash and balances with the central bank Group N$’000

As at 30 June 2019

Namibia 1,089,394 Botswana 335,258

South Africa

United Kingdom

United States of America

Zambia 147,964 Other countries2 –

1,572,616

Financial assets at fair value through other compre- hensive income N$’000

3,535,669 730,904 476,152

– – – –

4,742,725

Financial assets at fair value through profit or loss N$’000

2,024,867 12,321 – – – – –

2,037,188

Due from other banks N$’000

2,986 811,106 51,634 13,818 743,561 3,761 97,177

1,724,043

Loans and advances to customers N$’000

31,803,077 5,476,856 – – – 769,650 –

38,049,583

Financial

assets at amortised cost N$’000

643,678 – – – – 216,636 –

860,314

Other assets N$’000

255,261 113,837 357 – – 43,285 –

412,740

Total N$’000

39,354,932 7,480,282 528,143 13,818 743,561 1,181,296 97,177

49,399,209

– – –

There are no exposures to other foreign countries which are not recorded on the statement of financial position.

1 Other foreign currency exposures relate mainly to exposures to the European Union euro: N$67.9 million due from other banks.

2 Other foreign currency exposures relate mainly to exposures to the European Union euro: N$92.0 million due from other banks.

181