Page 255 - Capricorn IAR 2020

P. 255

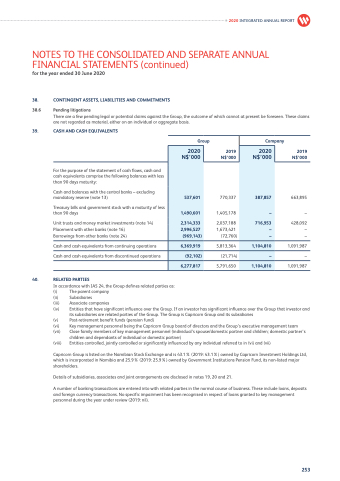

39. CASH AND CASH EQUIVALENTS

For the purpose of the statement of cash flows, cash and cash equivalents comprise the following balances with less than 90 days maturity:

Cash and balances with the central banks – excluding mandatory reserve (note 13)

Treasury bills and government stock with a maturity of less than 90 days

Unit trusts and money market investments (note 14) Placement with other banks (note 16)

Borrowings from other banks (note 24)

Cash and cash equivalents from continuing operations Cash and cash equivalents from discontinued operations

40. RELATED PARTIES

In accordance with IAS 24, the Group defines related parties as:

(i) The parent company

(ii) Subsidiaries

(iii) Associate companies

Group

Company

2020 INTEGRATED ANNUAL REPORT

NOTES TO THE CONSOLIDATED AND SEPARATE ANNUAL FINANCIAL STATEMENTS (continued)

for the year ended 30 June 2020

38. CONTINGENT ASSETS, LIABILITIES AND COMMITMENTS

38.6 Pending litigations

There are a few pending legal or potential claims against the Group, the outcome of which cannot at present be foreseen. These claims are not regarded as material, either on an individual or aggregate basis.

2020 N$’000

2020 N$’000

537,601

770,337

1,405,178

2,037,188 1,673,421

(72,760)

387,857

1,490,601

–

2,314,333

716,953

2,996,527

–

(969,143)

1,104,810

–

6,369,919

5,813,364

(92,102)

6,277,817

(21,714)

–

5,791,650

1,104,810

2019 N$’000

2019 N$’000

663,895

–

428,092 – –

1,091,987 – 1,091,987

(iv) Entities that have significant influence over the Group. If an investor has significant influence over the Group that investor and its subsidiaries are related parties of the Group. The Group is Capricorn Group and its subsidiaries

(v) Post-retirement benefit funds (pension fund)

(vi) Key management personnel being the Capricorn Group board of directors and the Group’s executive management team

(vii) Close family members of key management personnel (individual’s spouse/domestic partner and children; domestic partner’s

children and dependants of individual or domestic partner)

(viii) Entities controlled, jointly controlled or significantly influenced by any individual referred to in (vi) and (vii)

Capricorn Group is listed on the Namibian Stock Exchange and is 43.1% (2019: 43.1%) owned by Capricorn Investment Holdings Ltd, which is incorporated in Namibia and 25.9% (2019: 25.9%) owned by Government Institutions Pension Fund, its non-listed major shareholders.

Details of subsidiaries, associates and joint arrangements are disclosed in notes 19, 20 and 21.

A number of banking transactions are entered into with related parties in the normal course of business. These include loans, deposits and foreign currency transactions. No specific impairment has been recognised in respect of loans granted to key management personnel during the year under review (2019: nil).

253