Page 10 - Nevada County CFAO

P. 10

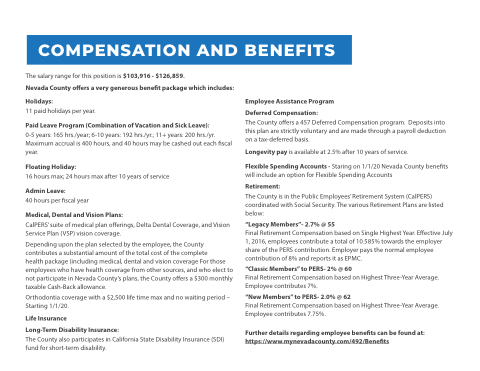

COMPENSATION AND BENEFITS

The salary range for this position is is $103 916 - $126 859 Nevada County offers a a a a a very generous benefit package which includes:

Holidays:

11 paid holidays per year Paid Leave Leave Program (Combination of Vacation and Sick Leave):

0-5 years: years: years: 165 hrs hrs hrs /year 6-10 years: years: years: 192 hrs hrs hrs /yr /yr 11+ years: years: years: 200 hrs hrs hrs /yr /yr Maximum accrual is fis 400 hours hours and 40 40 hours hours may be cashed out each fiscal year Floating Holiday:

16 hours hours max max 24 hours hours max max after 10 years of service

Admin Leave:

40 hours per fiscal year Medical Dental and Vision Plans:

CalPERS’ suite of o medical plan offerings Delta Dental Coverage and Vision Service Plan (VSP) vision coverage Depending upon the the the plan selected by the the the employee the the the County contributes a a a a a substantial amount of of the the total cost of of the the complete

health package (including medical dental and vision coverage For those employees who who have health coverage from other sources and who who elect to not participate in Nevada County’s plans the County County offers a a a a a a $300 monthly taxable Cash-Back allowance Orthodontia coverage with a a a a a a $2 500 life time max and no waiting period – Starting 1/1/20 Life Insurance

Long-Term Disability Insurance:

The County also participates in California State Disability Insurance

(SDI) fund for short-term disability Employee Assistance Program Deferred Compensation:

The County offers a a a 457 Deferred Compensation program Deposits into this plan are are strictly voluntary and are are made through a a a a a a a a payroll deduction on a a a tax-deferred basis Longevity pay is available at 2 5% after 10 years of service

Flexible Spending Accounts - Staring on 1/1/20 Nevada County benefits

will include an option for Flexible Spending Accounts Retirement:

The County is in the Public Employees’ Retirement System (CalPERS) coordinated with Social Security The various Retirement Plans are listed below:

“Legacy Members”- 2 7% @ 55

Final Retirement Compensation based on on Single Highest Year Effective July 1 1 1 2016 employees contribute a a a total of 10 585% towards the employer share of the the PERS contribution Employer pays the the normal employee contribution of 8% and reports it as EPMC “Classic Members” to PERS- 2% @ 60

Final Retirement Compensation based on on Highest Three-Year Average Employee contributes 7% “New Members” to PERS- 2 2 0% @ 62

Final Retirement Compensation based on on Highest Three-Year Average Employee contributes 7 7 75% Further details regarding employee benefits

can be be found at: https://www mynevadacounty com/492/Benefits