Page 52 - Sector Alarm Annual Report 2020

P. 52

52/53

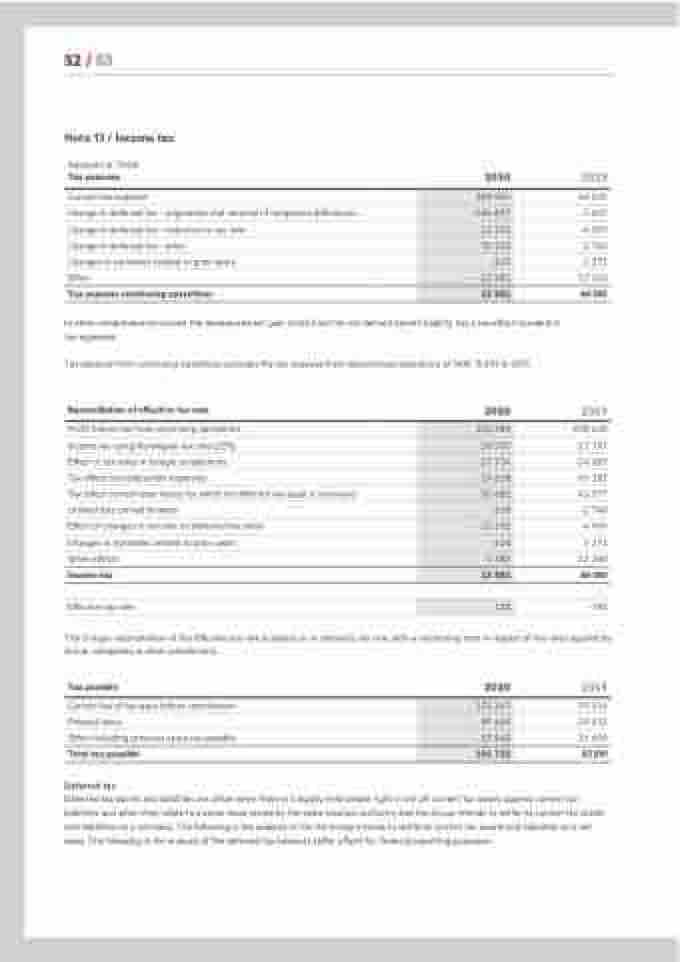

Note 13 / Income tax

Amounts in TNOK

Tax expense

Current tax expense

Change in deferred tax - origination and reversal of temporary differences

Change in deferred tax - reduction in tax rate

Change in deferred tax - other

Changes in estimates related to prior years

Other

Tax expense continuing operations

2020 2019

62 529 5 033 -4 909 2 746 3 271 17 510 86 180

109 954

-104 837

-12 191

35 150

-215

-13 981

13 881

In other comprehensive income the remeasurement gain (loss) from the net defined benefit liability has a tax effect included in tax expenses

Tax expense from continuing operations excludes the tax expense from discontinued operations of NOK 15.009 in 2019.

Reconciliation of effective tax rate

Profit before tax from continuing operations

Income tax using Norwegian tax rate (22%)

Effect of tax rates in foregin jurisdictions

Tax effect non deductible expenses

Tax effect current-year losses for which no deferred tax asset is reconised

Utilized loss carried forward

Effect of changes in tax rate on deferred tax items

Changes in estimates related to prior years

Other effects

Income tax

Effective tax rate

2020 2019

-108 430 -23 787 -24 687

85 183 41 577 -2 748 -4 909 3 271 12 280 86 180

12% -79%

120 485

26 507

-27 734

-19 618

50 681

-168

-12 191

-215

-3 382

13 881

The Group’s reconciliation of the effective tax rate is based on its domestic tax rate, with a reconciling item in respect of tax rates applied by Group companies in other jurisdictions.

Tax payable

Current tax of tax base before contribution

Prepaid taxes

Other including previous years tax payable

Total tax payable

Deferred tax

2020

2019

75 516 -29 531 36 606 82 591

133 247

-85 469

53 945

101 722

Deferred tax assets and liabilities are offset when there is a legally enforceable right to set off current tax assets against current tax liabilities and when they relate to income taxes levied by the same taxation authority and the Group intends to settle its current tax assets and liabilities on a net basis. The following is the analysis of the the Group intends to settle its current tax assets and liabilities on a net basis. The following is the analysis of the deferred tax balances (after offset) for financial reporting purposes: