Page 3 - 27th Street Opportunity Zone Brochure

P. 3

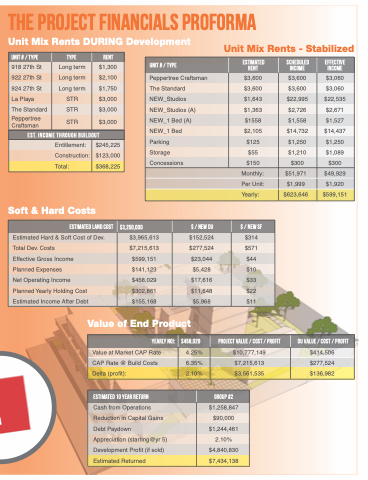

The Project Financials PROFORMA

Unit Mix Rents DURING Development

Soft & Hard Costs

Unit Mix Rents - Stabilized

Unit # / Type

918 27th St

922 27th St

924 27th St

La Playa

The Standard

Peppertree Craftsman

Type

Long term Long term Long term STR

STR STR

Rent

$1,300 $2,100 $1,750 $3,000 $3,000

$3,000

Est. Income Through Buildout

Entitlement: Construction: Total:

$245,225 $123,000 $368,225

Unit # / Type

Peppertree Craftsman The Standard NEW_Studios NEW_Studios (A) NEW_1 Bed (A) NEW_1 Bed

Parking Storage Concessions

Estimated Rent

$3,600 $3,600 $1,643 $1,363 $1558 $2,105 $125 $55 $150

Scheduled Income

$3,600

$3,600 $22,995 $2,726 $1,558 $14,732 $1,250 $1,210 $300

Effective Income

$3,060

$3,060 $22,535 $2,671 $1,527 $14,437 $1,250 $1,089 $300

Monthly:

$51,971

$49,929

Per Unit:

$1,999

$1,920

Yearly:

$623,646

$599,151

Estimated Land Cost

Estimated Hard & Soft Cost of Dev. Total Dev. Costs

Effective Gross Income

Planned Expenses

Net Operating Income Planned Yearly Holding Cost Estimated Income After Debt

$3,250,000

$3,965,613 $7,215,613 $599,151 $141,123 $458,029 $302,861 $155,168

$/NEWDU

$152,524 $277,524 $23,044 $5,428 $17,616 $11,648 $5,968

$/NEWSF

$314

$571

$44

$10

$33

$22

$11

Value of End Product

Yearly NOI:

Value at Market CAP Rate

$458,029

4.25%

Project Value / Cost / Profit

$10,777,149

DU Value / Cost / Profit

$414,506

CAP Rate @ Build Costs Delta (profit):

6.35% 2.10%

$7,215,613 $3,561,535

$277,524 $136,982

Estimated 10 Year Return

Cash from Operations Reduction in Capital Gains Debt Paydown

Appreciation (starting@yr 5) Development Profit (if sold) Estimated Returned

Group #2

$1,258,847 $90,000 $1,244,461 2.10% $4,840,830 $7,434,138