Page 69 - bne magazine February 2024_20240206

P. 69

bne February 2024 New Europe in Numbers I 69

Eurozone faces fifth consecutive quarter of industrial contraction as Germany struggles

bne IntelliNews

Eurozone industrial production dropped by another 0.3% month-on-month

in November. Germany is among

the worst affected countries and is dragging the rest of the EU down with it to the worst performance in a decade, Oxford Economics said in a note on January 15.

Europe has been battered by the combination of the ongoing polycrisis that began during the global pandemic. That was followed by an energy crisis after Europe was cut off from most

of Russia’s gas deliveries that sent the price for energy rocketing. More recently the boomerang effect of the extreme sanctions on Russia are bouncing back to hurt the EU more than they do Russia.

Russia ended 2023 with a better than expected 4% GDP growth, according to preliminary estimates and is currently seeing industrial production grow faster than anywhere else in Europe thanks to the military Keynesianism effect of heavy war spending.

The industrial production performance amongst the 27 member states is mixed, but Germany and Italy reported contractions, while France and Spain showed some expansion. However, all sub-sectors, excluding energy and non- durable consumer goods, recorded

a decline, reports Oxford Economics.

Europe’s figures hint at an imminent contraction in the eurozone's industrial sector for the fourth quarter, marking the fifth consecutive quarter of decline. Lingering weak confidence data and

a negative carry-over from previous periods indicate that the EU members will continue to face challenges as 2024 gets underway.

Germany, the largest economy in the eurozone, saw its GDP contract by 0.1% in 2023. The statistical office

reported a 0.3% quarter-on-quarter contraction in the fourth quarter, as earlier expectations of a weak end

to the year were borne out. However, upward revisions in previous quarters somewhat mitigated the economic downturn.

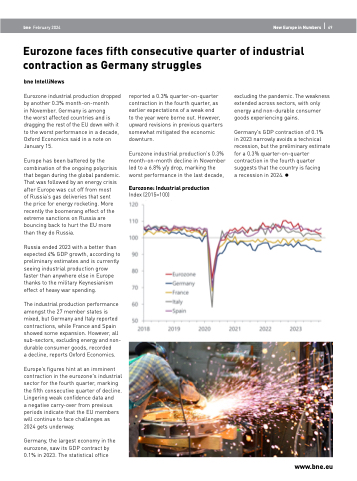

Eurozone industrial production's 0.3% month-on-month decline in November led to a 6.8% y/y drop, marking the worst performance in the last decade,

Eurozone: Industrial production

Index (2015=100)

excluding the pandemic. The weakness extended across sectors, with only energy and non-durable consumer goods experiencing gains.

Germany's GDP contraction of 0.1%

in 2023 narrowly avoids a technical recession, but the preliminary estimate for a 0.3% quarter-on-quarter contraction in the fourth quarter suggests that the country is facing

a recession in 2024.

www.bne.eu