Page 18 - bne monthly magazine October 2022

P. 18

18 I Companies & Markets bne October 2022

bne:Funds

EM debt crisis around the corner

Ben Aris in Berlin

Soaring inflation, a strong dollar and a complete over- haul of global energy markets are playing hell with Emerging Market debt. The world is now teetering on the edge of a global debt crisis, warns Oxford Economics in a research paper released on September 6.

“The latest emerging market (EM) debt crisis is upon us, with the dollar-denominated debt of 25 EM sovereigns trading at yields of more than 1,000 bps,” Gabriel Sterne, the head of global EM research at Oxford Economics, said in a note emailed to clients. “Because this wave is only just breaking and is likely to crash on frontier markets and small developing economies this time around, it hasn’t yet grabbed the same headlines as the last wave of sovereign defaults in the 1980s – when most commodity exporters defaulted at least once.”

Earlier this year the International Monetary Fund (IMF) warned that the world was facing stagflation, which last time it reared its head in the 1970s led to multiple financial crises as debt loads became unmanageable. Sri Lanka’s economy has already blown up, causing a change of government, and at least four African countries, including Ghana, Egypt, Mozam- bique and Angola, have already been driven into the arms of the IMF after their public finances became untenable. And things are likely to only get worse.

Mature EM sovereigns usually choose default or devaluation to get out their bind. Having issued predominantly in local currency, the preferred way to reduce debt has been a deep depreciation, stoking inflation, introducing capital controls and negative real interest rates on local currency debt.

“Among stricken EMs this time, Nigeria, Egypt, Pakistan each fall into that category, giving creditors of FX-denominated debt a bit of space between them and a haircut,” says Sterne. “But the debt of most frontiers is predominantly dollar- denominated – and therefore prone to defaults once nasty shocks materialise.”

The dollar’s rise has been turning the screws intolerable tight this year, up some 20% since the start of this year. And much of this debt is owed to international financial institutions

www.bne.eu

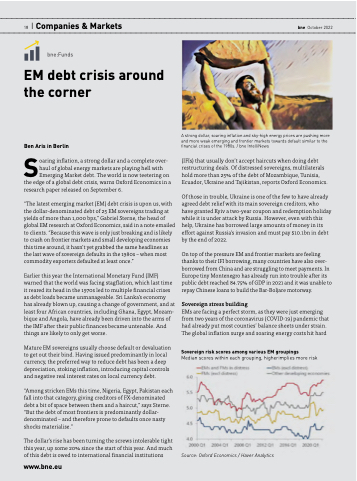

A strong dollar, soaring inflation and sky-high energy prices are pushing more and more weak emerging and frontier markets towards default similar to the financial crises of the 1980s. / bne IntelliNews

(IFIs) that usually don’t accept haircuts when doing debt restructuring deals. Of distressed sovereigns, multilaterals hold more than 25% of the debt of Mozambique, Tunisia, Ecuador, Ukraine and Tajikistan, reports Oxford Economics.

Of those in trouble, Ukraine is one of the few to have already agreed debt relief with its main sovereign creditors, who have granted Kyiv a two-year coupon and redemption holiday while it is under attack by Russia. However, even with this help, Ukraine has borrowed large amounts of money in its effort against Russia’s invasion and must pay $10.1bn in debt by the end of 2022.

On top of the pressure EM and frontier markets are feeling thanks to their IFI borrowing, many countries have also over- borrowed from China and are struggling to meet payments. In Europe tiny Montenegro has already run into trouble after its public debt reached 84.75% of GDP in 2021 and it was unable to repay Chinese loans to build the Bar-Boljare motorway.

Sovereign stress building

EMs are facing a perfect storm, as they were just emerging from two years of the coronavirus (COVID-19) pandemic that had already put most counties’ balance sheets under strain. The global inflation surge and soaring energy costs hit hard

Sovereign risk scores among various EM groupings

Median scores within each grouping, higherimplies more risk

Source: Oxford Economics / Haver Analytics