Page 37 - UKRRptJul22

P. 37

7.0 FX

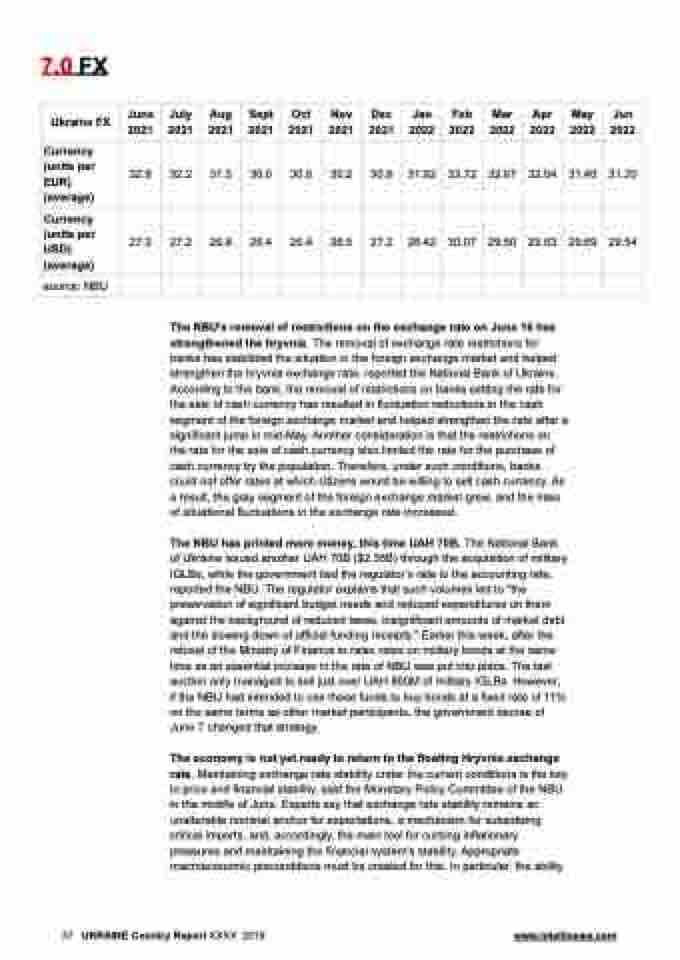

Ukraine FX

June 2021

July 2021

Aug 2021

Sept 2021

Oct 2021

Nov 2021

Dec 2021

Jan 2022

Feb 2022

Mar 2022

Apr 2022

May 2022

Jun 2022

Currency (units per EUR) (average)

32.8

32.2

31.5

30.6

30.6

30.2

30.8

31.92

33.72

32.67

32.04

31.40

31.20

Currency (units per USD) (average)

27.2

27.2

26.8

26.4

26.4

26.5

27.2

28.42

30.07

29.50

29.63

29.69

29.54

source: NBU

The NBU's removal of restrictions on the exchange rate on June 16 has strengthened the hryvnia. The removal of exchange rate restrictions for banks has stabilized the situation in the foreign exchange market and helped strengthen the hryvnia exchange rate, reported the National Bank of Ukraine. According to the bank, the removal of restrictions on banks setting the rate for the sale of cash currency has resulted in fluctuation reductions in the cash segment of the foreign exchange market and helped strengthen the rate after a significant jump in mid-May. Another consideration is that the restrictions on the rate for the sale of cash currency also limited the rate for the purchase of cash currency by the population. Therefore, under such conditions, banks could not offer rates at which citizens would be willing to sell cash currency. As a result, the gray segment of the foreign exchange market grew, and the risks of situational fluctuations in the exchange rate increased.

The NBU has printed more money, this time UAH 70B. The National Bank of Ukraine issued another UAH 70B ($2.35B) through the acquisition of military IGLBs, while the government tied the regulator’s rate to the accounting rate, reported the NBU. The regulator explains that such volumes led to "the preservation of significant budget needs and reduced expenditures on them against the background of reduced taxes, insignificant amounts of market debt and the slowing down of official funding receipts." Earlier this week, after the refusal of the Ministry of Finance to raise rates on military bonds at the same time as an essential increase in the rate of NBU was put into place. The last auction only managed to sell just over UAH 800M of military IGLBs. However, if the NBU had intended to use those funds to buy bonds at a fixed rate of 11% on the same terms as other market participants, the government decree of June 7 changed that strategy.

The economy is not yet ready to return to the floating Hryvnia exchange rate. Maintaining exchange rate stability under the current conditions is the key to price and financial stability, said the Monetary Policy Committee of the NBU in the middle of June. Experts say that exchange rate stability remains an unalterable nominal anchor for expectations, a mechanism for subsidizing critical imports, and, accordingly, the main tool for curbing inflationary pressures and maintaining the financial system's stability. Appropriate macroeconomic preconditions must be created for this. In particular, the ability

37 UKRAINE Country Report XXXX 2018 www.intellinews.com