Page 101 - bneIntelliNews monthly country report Russia May 2024

P. 101

market).

“MTS Bank has one of the highest growth rates in unsecured retail lending in the market,” Renaissance Capital analysts commented, noting that between 2020 and 2023, the bank's loan book grew at an average annual rate of 39%, more than twice as fast as the market.

In 2023 33% of the bank's operating income came from net fee and commission income, mostly composed out of commissions on customers' settlement transactions, agency fees for the sale of insurance products and other income.

At the same time, SberCIB analysts note that MTS Bank operates in a highly competitive segment of retail banking services, and the number of clients it has is "many times smaller than that of the leaders [of the market]".

Therefore, SberCIB analysts warn that increased competition and higher cost of attracting clients "may limit the growth rate of MTS Bank or worsen the quality of this growth, reducing the profitability of the business".

The strategic development plan of MTS Bank until 2028 guides for ROE (return on equity) growth of up to 30%. However, in 2023, the bank's ROE was only 19%, while Sberbank's ROE reached 25.3%, VTB's ROE was 22.3%, and Sovcombank's ROE was 45%.

In addition, as warned by Alfa Bank analysts, MTS Bank currently has no long history of generating ROE above 20% - the average over the last five years is estimated at 9.7%, and the maximum was reached in 2023.

Sources told Kommersant daily that financial market players look at MTS Bank with scepticism, but the demand for the IPO is nevertheless expected to be high from both retail and institutional investors.

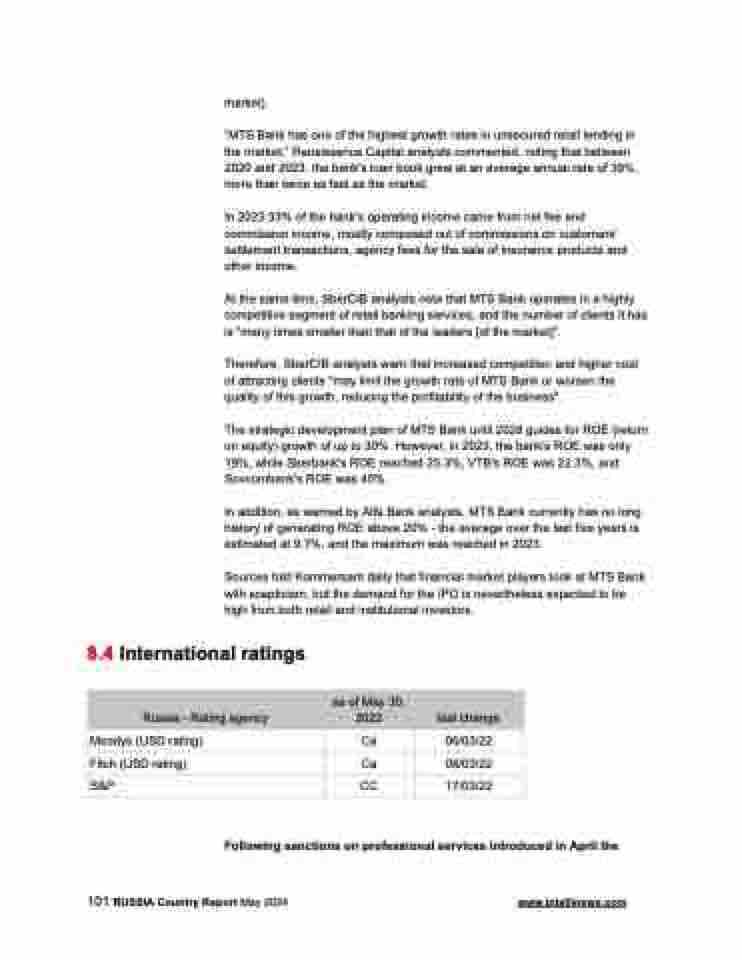

8.4 International ratings

Russia - Rating agency

as of May 30, 2022

last change

Moodys (USD rating)

Ca

06/03/22

Fitch (USD rating)

Ca

08/03/22

S&P

CC

17/03/22

Following sanctions on professional services introduced in April the

101 RUSSIA Country Report May 2024 www.intellinews.com