Page 98 - bneIntelliNews monthly country report Russia May 2024

P. 98

the head of the Central Bank, Elvira Nabiullina. Companies are forced to increase wages in order to attract and retain employees, while the market for this money will not have enough goods and services at old prices.

In addition, from July 1, the Central Bank decided to increase premiums on risk coefficients for unsecured consumer loans with the full cost of the loan from 25% to 40% and establish premiums for car loans with a debt burden of more than 50%. This is necessary to limit the debt burden of Russians and increase the stability of banks.

Nabiullina also noted the increased risk of secondary sanctions and the complication of international payments. At the same time, trade with friendly countries is “actively growing,” and the Bank of Russia is in constant contact with foreign partners and is working to solve the problem.

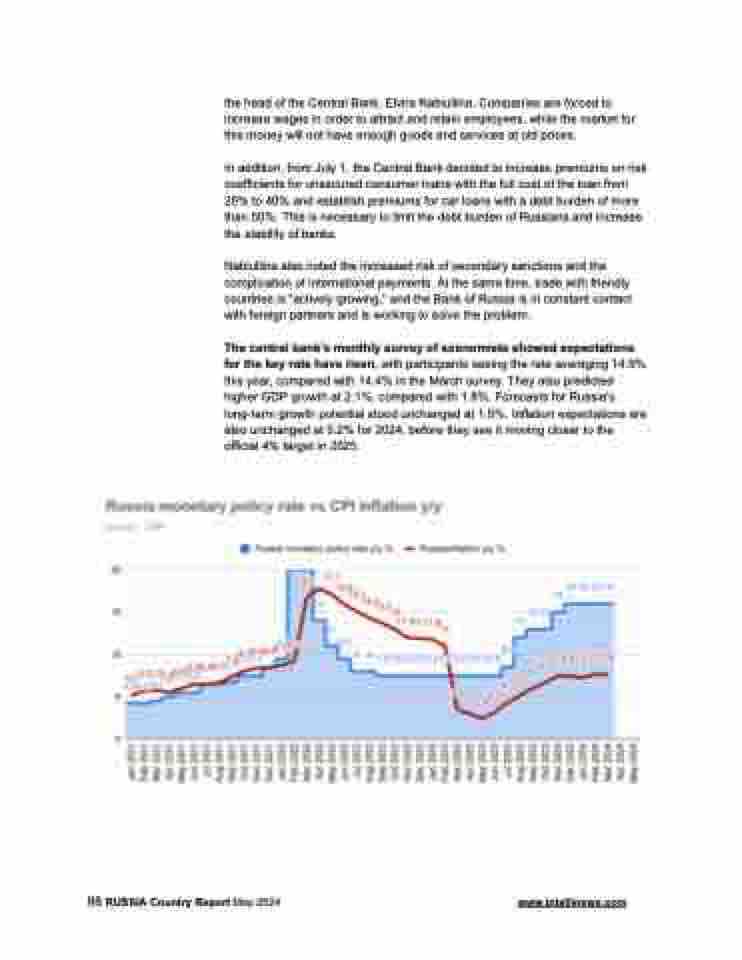

The central bank’s monthly survey of economists showed expectations for the key rate have risen, with participants seeing the rate averaging 14.9% this year, compared with 14.4% in the March survey. They also predicted higher GDP growth at 2.1%, compared with 1.8%. Forecasts for Russia’s long-term growth potential stood unchanged at 1.5%. Inflation expectations are also unchanged at 5.2% for 2024, before they see it moving closer to the official 4% target in 2025.

98 RUSSIA Country Report May 2024 www.intellinews.com