Page 50 - UKRRptOct22

P. 50

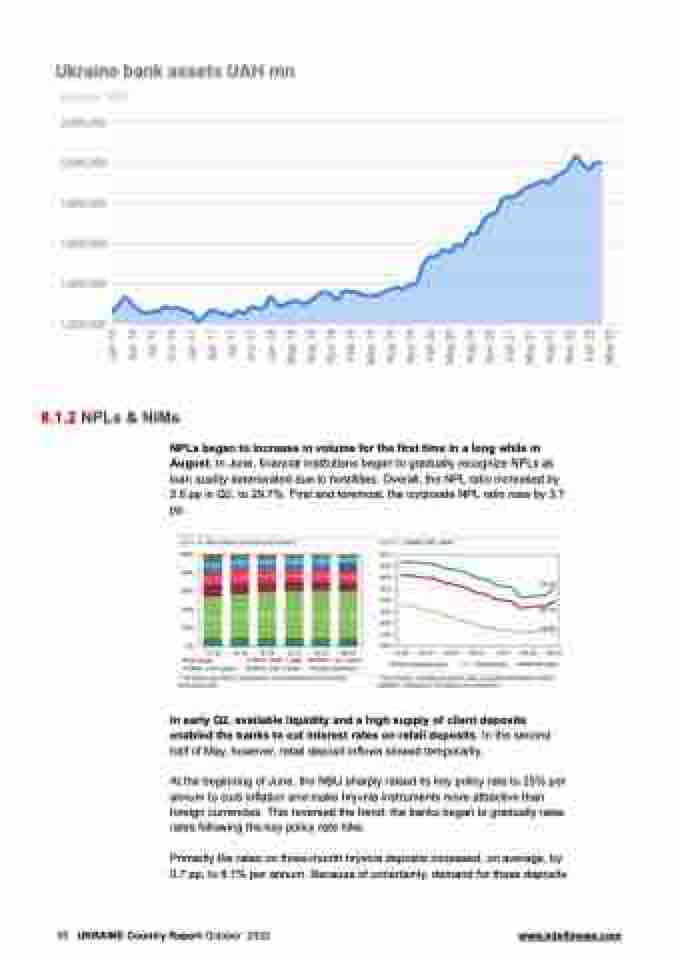

8.1.2 NPLs & NIMs

NPLs began to increase in volume for the first time in a long while in August. In June, financial institutions began to gradually recognize NPLs as loan quality deteriorated due to hostilities. Overall, the NPL ratio increased by 2.6 pp in Q2, to 29.7%. First and foremost, the corporate NPL ratio rose by 3.7 pp.

In early Q2, available liquidity and a high supply of client deposits enabled the banks to cut interest rates on retail deposits. In the second half of May, however, retail deposit inflows slowed temporarily.

At the beginning of June, the NBU sharply raised its key policy rate to 25% per annum to curb inflation and make hryvnia instruments more attractive than foreign currencies. This reversed the trend: the banks began to gradually raise rates following the key policy rate hike.

Primarily the rates on three-month hryvnia deposits increased, on average, by 0.7 pp, to 8.1% per annum. Because of uncertainty, demand for these deposits

50 UKRAINE Country Report October 2022 www.intellinews.com