Page 12 - RusRPTAug24

P. 12

12 I Companies & Markets bne August 2024

It was also reported earlier this year that Lidl started construction of its first store in Bosnia & Herzegovina in March. The store will be located in the capital Sarajevo.

Local champions

There are also successful home grown chains in the region, some of which have attracted the interest of private equity investors.

In October 2023, Ahold Delhaize announced it agreed to buy Romania's Profi chain from private equity firm MidEuropa for €1.3bn. The deal was the largest exit by a private equity fund in the food segment in Central and Eastern Europe.

At the time, Profi operated the most extensive retail chain in Romania in terms of outlets and was the third-largest retailer in the country by turnover after Lidl and Kaufland. Its network numbered more than 1,650 stores.

Delhaize’s existing chain Mega Image was the sixth-largest player by turnover. Delhaize said it will add Profi to its family of brands, meaning there will be no integration of the two chains. "Romania is an attractive market, with a development supported by solid investments,” the company said on announcing the deal.

Also in Romania, as reported by bne IntelliNews’ Romanian correspondent, hypermarket chain La Cocos is expanding in a market dominated by foreign players.

Earlier this year, La Cocos has announced the opening of its fourth store, in the central Romanian city of Brasov, in the first step of an expansion plan that includes the launch of five more units in 2024 and 2025.

La Cocos is a new concept in the Romanian market, a retail format which offers three price levels to its customers, depending on the quantity purchased. Before opening the store in Brasov, La Cocos was operating three hypermarkets – two in Ploiesti and one in Bucharest.

Another significant regional player in the area is Slovenia- based Mercator, owned by Croatia’s Fortenova Group. Mercator operates not only in Slovenia but also in Bosnia, Croatia, Montenegro and Serbia.

In 2023, Mercator signed a deal to acquire the shares of Engrotus, which operates about 260 Tus stores nationwide. The acquisition did not include the 43 Tus drugstores. Fortenova said at the time that the deal would create a major retail force in Slovenia.

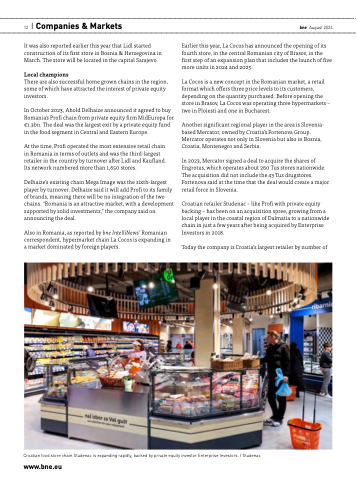

Croatian retailer Studenac – like Profi with private equity backing – has been on an acquisition spree, growing from a local player in the coastal region of Dalmatia to a nationwide chain in just a few years after being acquired by Enterprise Investors in 2018.

Today the company is Croatia’s largest retailer by number of

Croatian food store chain Studenac is expanding rapidly, backed by private equity investor Enterprise Investors. / Studenac

www.bne.eu