Page 5 - MEOG 32

P. 5

MEOG COMMENTARY MEOG

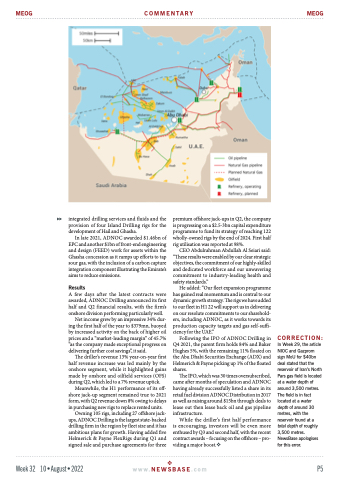

integrated drilling services and fluids and the provision of four Island Drilling rigs for the development of Hail and Ghasha.

In late 2021, ADNOC awarded $1.46bn of EPC and another $1bn of front-end engineering and design (FEED) work for assets within the Ghasha concession as it ramps up efforts to tap sour gas, with the inclusion of a carbon capture integration component illustrating the Emirate’s aims to reduce emissions.

Results

A few days after the latest contracts were awarded, ADNOC Drilling announced its first half and Q2 financial results, with the firm’s onshore division performing particularly well.

Net income grew by an impressive 34% dur- ing the first half of the year to $379mn, buoyed by increased activity on the back of higher oil prices and a “market-leading margin” of 45.7% “as the company made exceptional progress on delivering further cost savings”, it said.

The driller’s revenue 13% year-on-year first half revenue increase was led mainly by the onshore segment, while it highlighted gains made by onshore and oilfield services (OFS) during Q2, which led to a 7% revenue uptick.

Meanwhile, the H1 performance of its off- shore jack-up segment remained true to 2021 form, with Q2 revenue down 8% owing to delays in purchasing new rigs to replace rented units.

Owning 105 rigs, including 27 offshore jack- ups, ADNOC Drilling is the largest state-backed drilling firm in the region by fleet size and it has ambitious plans for growth. Having added five Helmerick & Payne FlexRigs during Q1 and signed sale and purchase agreements for three

premium offshore jack-ups in Q2, the company is progressing on a $2.5-3bn capital expenditure programme to fund its strategy of reaching 122 wholly-owned rigs by the end of 2024. First half rig utilisation was reported at 98%.

CEO Abdulrahman Abdullah Al Seiari said: “These results were enabled by our clear strategic objectives, the commitment of our highly-skilled and dedicated workforce and our unwavering commitment to industry-leading health and safety standards.”

He added: “Our fleet expansion programme has gained real momentum and is central to our dynamic growth strategy. The rigs we have added to our fleet in H1 22 will support us in delivering on our resolute commitments to our sharehold- ers, including ADNOC, as it works towards its production capacity targets and gas self-suffi- ciency for the UAE.”

Following the IPO of ADNOC Drilling in Q4 2021, the parent firm holds 84% and Baker Hughes 5%, with the remaining 11% floated on the Abu Dhabi Securities Exchange (ADX) and Helmerich & Payne picking up 1% of the floated shares.

The IPO, which was 30 times oversubscribed, came after months of speculation and ADNOC having already successfully listed a share in its retail fuel division ADNOC Distribution in 2017 as well as raising around $15bn through deals to lease out then lease back oil and gas pipeline infrastructure.

While the driller’s first half performance is encouraging, investors will be even more enthused by Q3 and second half, with the recent contract awards – focusing on the offshore – pro- viding a major boost.

CORRECTION:

In Week 29, the article NIOC and Gazprom sign MoU for $40bn deal stated that the reservoir of Iran’s North Pars gas field is located at a water depth of around 3,500 metres. The field is in fact located at a water depth of around 30 metres, with the reservoir found at a total depth of roughly 3,500 metres. NewsBase apologises for this error.

Week 32 10•August•2022 w w w . N E W S B A S E . c o m

P5