Page 35 - bne IntelliNews monthly magazine May 2024

P. 35

bne May 2024 Cover story I 35

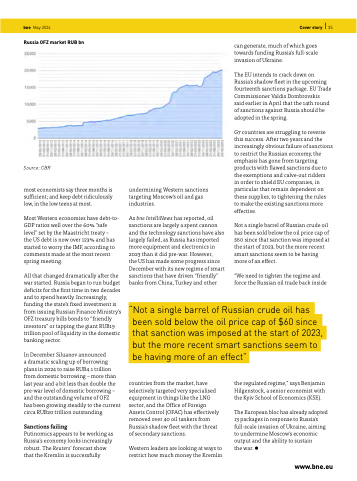

Russia OFZ market RUB bn

can generate, much of which goes towards funding Russia's full-scale invasion of Ukraine.

The EU intends to crack down on Russia’s shadow fleet in the upcoming fourteenth sanctions package. EU Trade Commissioner Valdis Dombrovskis

said earlier in April that the 14th round of sanctions against Russia should be adopted in the spring.

G7 countries are struggling to reverse this success. After two years and the increasingly obvious failure of sanctions to restrict the Russian economy, the emphasis has gone from targeting products with flawed sanctions due to the exemptions and calve-out ridders

in order to shield EU companies, in particular that remain dependent on these supplies, to tightening the rules to make the existing sanctions more effective.

Not a single barrel of Russian crude oil has been sold below the oil price cap of $60 since that sanction was imposed at the start of 2023, but the more recent smart sanctions seem to be having more of an effect.

“We need to tighten the regime and force the Russian oil trade back inside

Source: CBR

most economists say three months is sufficient; and keep debt ridiculously low, in the low teens at most.

Most Western economies have debt-to- GDP ratios well over the 60% “safe level” set by the Maastricht treaty –

the US debt is now over 123% and has started to worry the IMF, according to comments made at the most recent spring meeting.

All that changed dramatically after the war started. Russia began to run budget deficits for the first time in two decades and to spend heavily. Increasingly, funding the state’s fixed investment is from issuing Russian Finance Ministry’s OFZ treasury bills bonds to “friendly investors” or tapping the giant RUB19 trillion pool of liquidity in the domestic banking sector.

In December Siluanov announced

a dramatic scaling up of borrowing plans in 2024 to raise RUB4.1 trillion from domestic borrowing – more than last year and a bit less than double the pre-war level of domestic borrowing – and the outstanding volume of OFZ

has been growing steadily to the current circa RUB20 trillion outstanding.

Sanctions failing

Putinomics appears to be working as Russia’s economy looks increasingly robust. The Reuters’ forecast show that the Kremlin is successfully

undermining Western sanctions targeting Moscow's oil and gas industries.

As bne IntelliNews has reported, oil sanctions are largely a spent cannon and the technology sanctions have also largely failed, as Russia has imported more equipment and electronics in 2023 than it did pre-war. However,

the US has made some progress since December with its new regime of smart sanctions that have driven “friendly” banks from China, Turkey and other

“Not a single barrel of Russian crude oil has been sold below the oil price cap of $60 since that sanction was imposed at the start of 2023, but the more recent smart sanctions seem to be having more of an effect”

countries from the market, have selectively targeted very specialised equipment in things like the LNG sector, and the Office of Foreign Assets Control (OFAC) has effectively removed over 40 oil tankers from Russia’s shadow fleet with the threat of secondary sanctions.

Western leaders are looking at ways to restrict how much money the Kremlin

the regulated regime,” says Benjamin Hilgenstock, a senior economist with the Kyiv School of Economics (KSE).

The European bloc has already adopted 13 packages in response to Russia's full-scale invasion of Ukraine, aiming to undermine Moscow's economic output and the ability to sustain

the war.

www.bne.eu