Page 110 - RusRPTJun24

P. 110

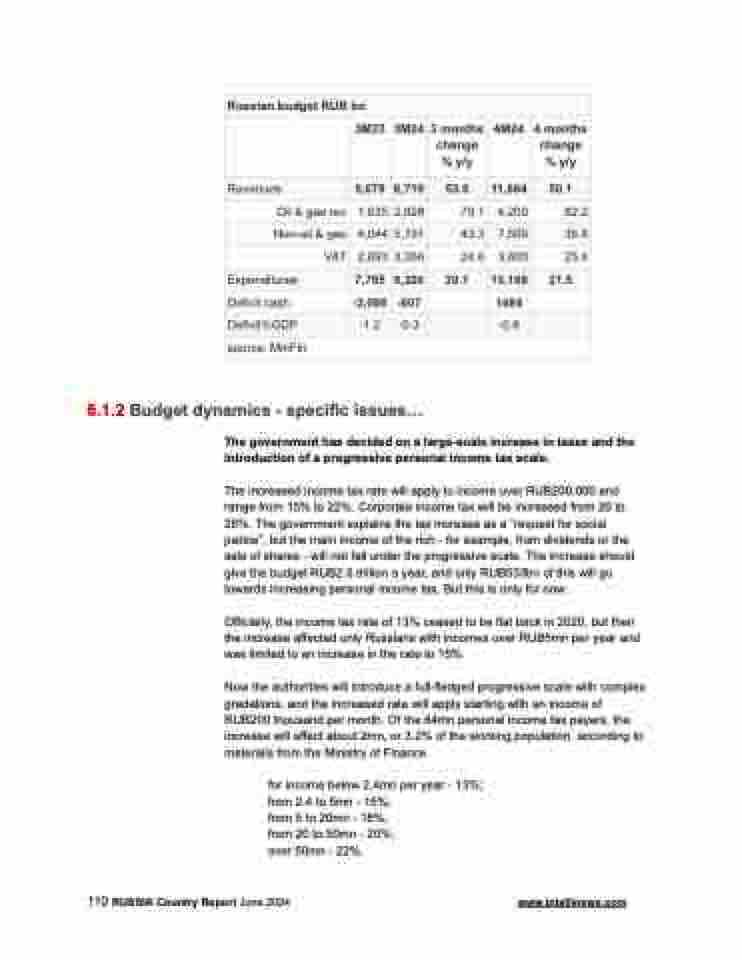

Russian budget RUB bn

3M23

3M24

3 months change % y/y

4M24

4 months change % y/y

Revenues

5,679

8,719

53.5

11,684

50.1

Oil & gas rev

1,635

2,928

79.1

4,200

82.2

Non-oil & gas

4,044

5,791

43.3

7,500

36.8

VAT

2,693

3,356

24.6

3,600

25.4

Expenditures

7,765

9,326

20.1

13,168

21.5

Deficit cash

-2,086

-607

1484

Deficit%GDP

-1.2

-0.3

-0.9

source: MinFin

6.1.2 Budget dynamics - specific issues...

The government has decided on a large-scale increase in taxes and the introduction of a progressive personal income tax scale.

The increased income tax rate will apply to income over RUB200,000 and range from 15% to 22%. Corporate income tax will be increased from 20 to 25%. The government explains the tax increase as a “request for social justice”, but the main income of the rich - for example, from dividends or the sale of shares - will not fall under the progressive scale. The increase should give the budget RUB2.6 trillion a year, and only RUB533bn of this will go towards increasing personal income tax. But this is only for now.

Officially, the income tax rate of 13% ceased to be flat back in 2020, but then the increase affected only Russians with incomes over RUB5mn per year and was limited to an increase in the rate to 15%.

Now the authorities will introduce a full-fledged progressive scale with complex gradations, and the increased rate will apply starting with an income of RUB200 thousand per month. Of the 64mn personal income tax payers, the increase will affect about 2mn, or 3.2% of the working population, according to materials from the Ministry of Finance.

for income below 2.4mn per year - 13%; from 2.4 to 5mn - 15%;

from 5 to 20mn - 18%;

from 20 to 50mn - 20%;

over 50mn - 22%.

110 RUSSIA Country Report June 2024 www.intellinews.com