Page 123 - RusRPTJun24

P. 123

,000

,000

,000

,000

,000

,000

,000

,000

,000

,000

000

,000

,000

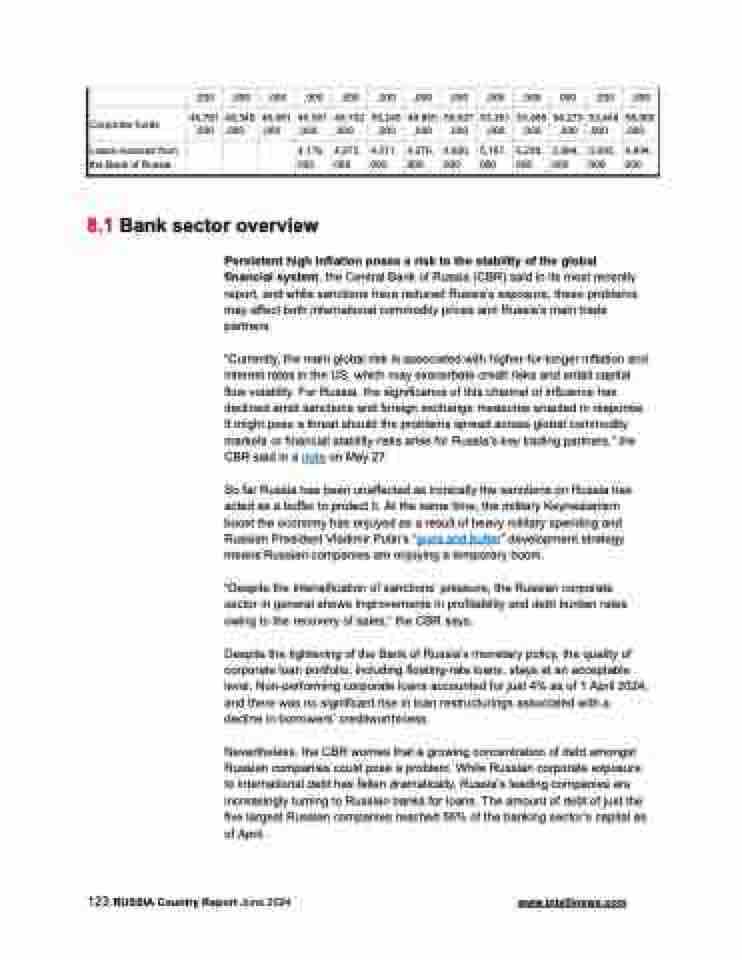

Corporate funds

45,781 ,000

46,349 ,000

46,581 ,000

46,581 ,000

49,732 ,000

50,240 ,000

49,855 ,000

50,637 ,000

53,381 ,000

53,465 ,000

54,273 ,000

53,448 ,000

56,065 ,000

Loans received from the Bank of Russia

4,176, 000

4,273, 000

4,571, 000

4,276, 000

4,620, 000

5,167, 000

5,239, 000

3,094, 000

3,093, 000

4,804, 000

8.1 Bank sector overview

Persistent high inflation poses a risk to the stability of the global financial system, the Central Bank of Russia (CBR) said in its most recently report, and while sanctions have reduced Russia’s exposure, these problems may affect both international commodity prices and Russia’s main trade partners.

“Currently, the main global risk is associated with higher-for-longer inflation and interest rates in the US, which may exacerbate credit risks and entail capital flow volatility. For Russia, the significance of this channel of influence has declined amid sanctions and foreign exchange measures enacted in response. It might pose a threat should the problems spread across global commodity markets or financial stability risks arise for Russia’s key trading partners,” the CBR said in a note on May 27.

So far Russia has been unaffected as ironically the sanctions on Russia has acted as a buffer to protect it. At the same time, the military Keynesianism boost the economy has enjoyed as a result of heavy military spending and Russian President Vladimir Putin’s “guns and butter” development strategy means Russian companies are enjoying a temporary boom.

“Despite the intensification of sanctions’ pressure, the Russian corporate sector in general shows improvements in profitability and debt burden rates owing to the recovery of sales,” the CBR says.

Despite the tightening of the Bank of Russia’s monetary policy, the quality of corporate loan portfolio, including floating-rate loans, stays at an acceptable level. Non-performing corporate loans accounted for just 4% as of 1 April 2024, and there was no significant rise in loan restructurings associated with a decline in borrowers’ creditworthiness.

Nevertheless, the CBR worries that a growing concentration of debt amongst Russian companies could pose a problem. While Russian corporate exposure to international debt has fallen dramatically, Russia’s leading companies are increasingly turning to Russian banks for loans. The amount of debt of just the five largest Russian companies reached 56% of the banking sector’s capital as of April.

123 RUSSIA Country Report June 2024 www.intellinews.com