Page 133 - RusRPTJun24

P. 133

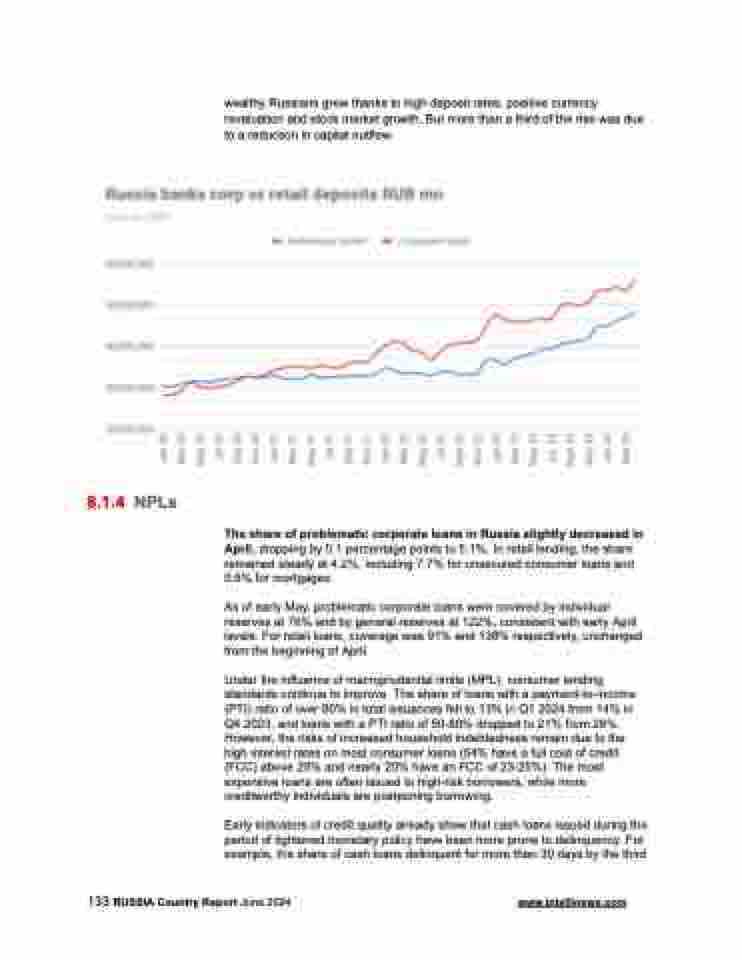

wealthy Russians grew thanks to high deposit rates, positive currency revaluation and stock market growth. But more than a third of the rise was due to a reduction in capital outflow.

8.1.4 NPLs

The share of problematic corporate loans in Russia slightly decreased in April, dropping by 0.1 percentage points to 5.1%. In retail lending, the share remained steady at 4.2%, including 7.7% for unsecured consumer loans and 0.6% for mortgages.

As of early May, problematic corporate loans were covered by individual reserves at 76% and by general reserves at 122%, consistent with early April levels. For retail loans, coverage was 91% and 138% respectively, unchanged from the beginning of April.

Under the influence of macroprudential limits (MPL), consumer lending standards continue to improve. The share of loans with a payment-to-income (PTI) ratio of over 80% in total issuances fell to 13% in Q1 2024 from 14% in Q4 2023, and loans with a PTI ratio of 50-80% dropped to 21% from 26%. However, the risks of increased household indebtedness remain due to the high interest rates on most consumer loans (54% have a full cost of credit (FCC) above 25% and nearly 20% have an FCC of 23-25%). The most expensive loans are often issued to high-risk borrowers, while more creditworthy individuals are postponing borrowing.

Early indicators of credit quality already show that cash loans issued during the period of tightened monetary policy have been more prone to delinquency. For example, the share of cash loans delinquent for more than 30 days by the third

133 RUSSIA Country Report June 2024 www.intellinews.com