Page 136 - RusRPTJun24

P. 136

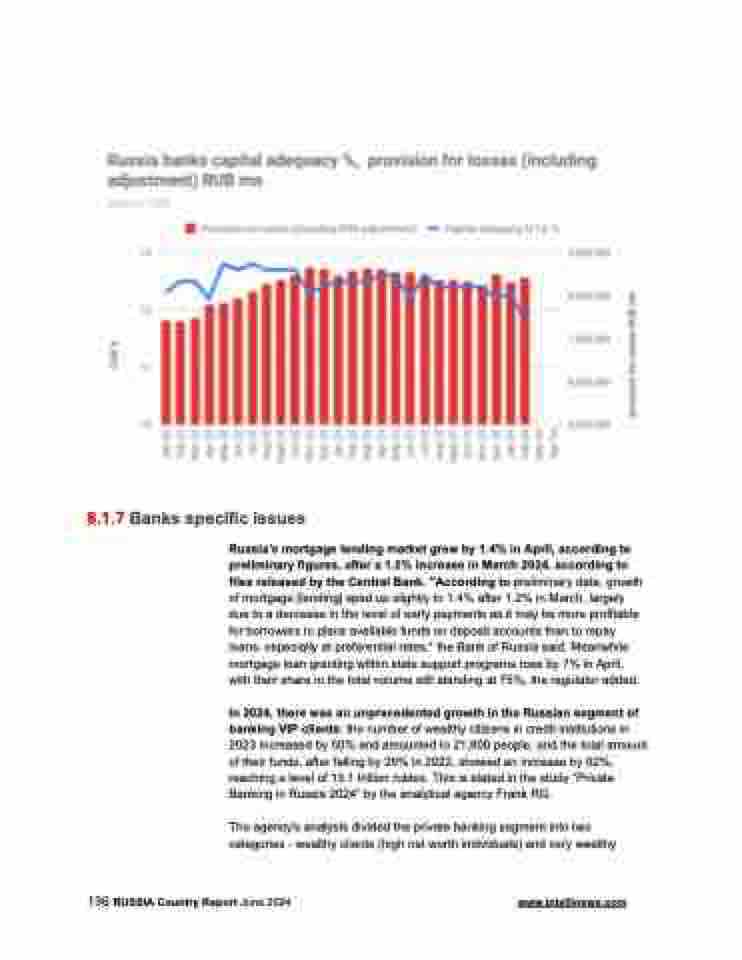

8.1.7 Banks specific issues

Russia’s mortgage lending market grew by 1.4% in April, according to preliminary figures, after a 1.2% increase in March 2024, according to files released by the Central Bank. "According to preliminary data, growth of mortgage [lending] sped up slightly to 1.4% after 1.2% in March, largely due to a decrease in the level of early payments as it may be more profitable for borrowers to place available funds on deposit accounts than to repay loans, especially at preferential rates," the Bank of Russia said. Meanwhile mortgage loan granting within state support programs rose by 7% in April, with their share in the total volume still standing at 75%, the regulator added.

In 2024, there was an unprecedented growth in the Russian segment of banking VIP clients: the number of wealthy citizens in credit institutions in 2023 increased by 50% and amounted to 21,800 people, and the total amount of their funds, after falling by 26% in 2022, showed an increase by 62%, reaching a level of 13.1 trillion rubles. This is stated in the study “Private Banking in Russia 2024” by the analytical agency Frank RG.

The agency's analysts divided the private banking segment into two categories - wealthy clients (high net worth individuals) and very wealthy

136 RUSSIA Country Report June 2024 www.intellinews.com