Page 159 - RusRPTJun24

P. 159

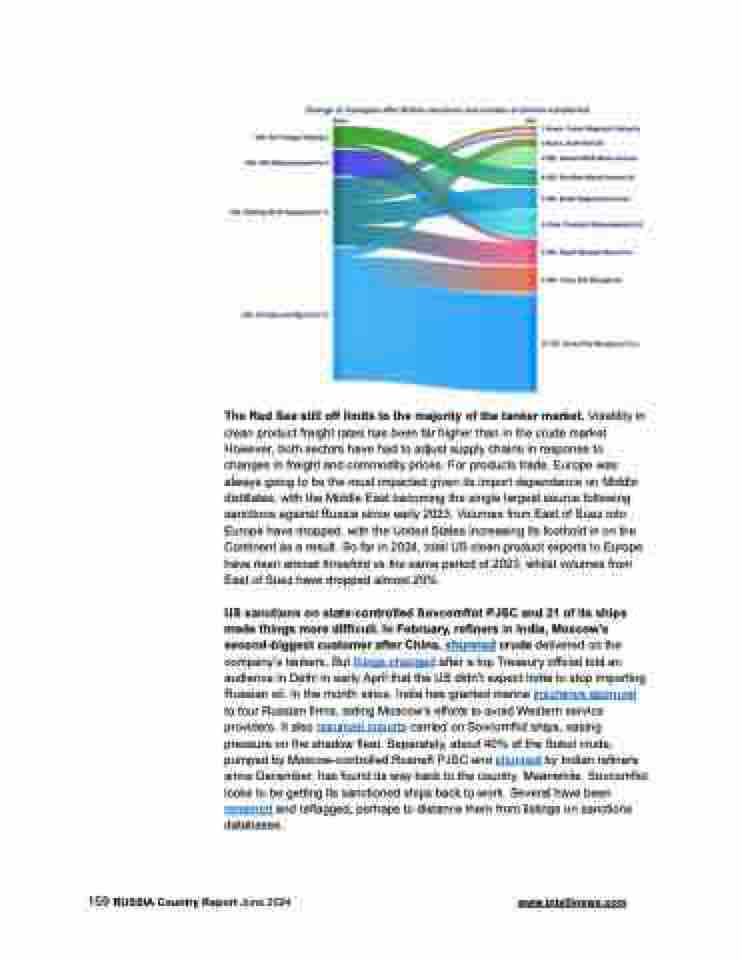

The Red Sea still off limits to the majority of the tanker market. Volatility in clean product freight rates has been far higher than in the crude market. However, both sectors have had to adjust supply chains in response to changes in freight and commodity prices. For products trade, Europe was always going to be the most impacted given its import dependence on Middle distillates, with the Middle East becoming the single largest source following sanctions against Russia since early 2023. Volumes from East of Suez into Europe have dropped, with the United States increasing its foothold in on the Continent as a result. So far in 2024, total US clean product exports to Europe have risen almost threefold vs the same period of 2023, whilst volumes from East of Suez have dropped almost 20%.

US sanctions on state-controlled Sovcomflot PJSC and 21 of its ships made things more difficult. In February, refiners in India, Moscow’s second-biggest customer after China, shunned crude delivered on the company’s tankers. But things changed after a top Treasury official told an audience in Delhi in early April that the US didn’t expect India to stop importing Russian oil. In the month since, India has granted marine insurance approval to four Russian firms, aiding Moscow’s efforts to avoid Western service providers. It also resumed imports carried on Sovcomflot ships, easing pressure on the shadow fleet. Separately, about 40% of the Sokol crude, pumped by Moscow-controlled Rosneft PJSC and shunned by Indian refiners since December, has found its way back to the country. Meanwhile, Sovcomflot looks to be getting its sanctioned ships back to work. Several have been renamed and reflagged, perhaps to distance them from listings on sanctions databases.

159 RUSSIA Country Report June 2024 www.intellinews.com