Page 81 - RusRPTJun24

P. 81

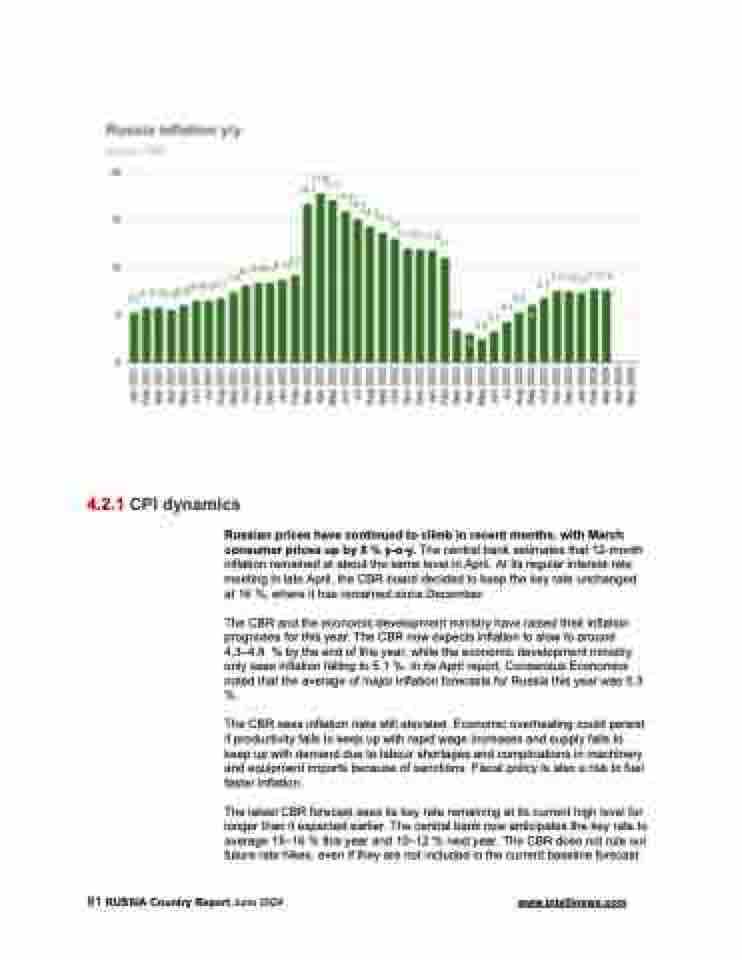

4.2.1 CPI dynamics

Russian prices have continued to climb in recent months, with March consumer prices up by 8 % y-o-y. The central bank estimates that 12-month inflation remained at about the same level in April. At its regular interest-rate meeting in late April, the CBR board decided to keep the key rate unchanged at 16 %, where it has remained since December.

The CBR and the economic development ministry have raised their inflation prognoses for this year. The CBR now expects inflation to slow to around 4.3–4.8 % by the end of this year, while the economic development ministry only sees inflation falling to 5.1 %. In its April report, Consensus Economics noted that the average of major inflation forecasts for Russia this year was 5.3 %.

The CBR sees inflation risks still elevated. Economic overheating could persist if productivity fails to keep up with rapid wage increases and supply fails to keep up with demand due to labour shortages and complications in machinery and equipment imports because of sanctions. Fiscal policy is also a risk to fuel faster inflation.

The latest CBR forecast sees its key rate remaining at its current high level for longer than it expected earlier. The central bank now anticipates the key rate to average 15–16 % this year and 10–12 % next year. The CBR does not rule out future rate hikes, even if they are not included in the current baseline forecast.

81 RUSSIA Country Report June 2024 www.intellinews.com