Page 109 - RusRPTJul22

P. 109

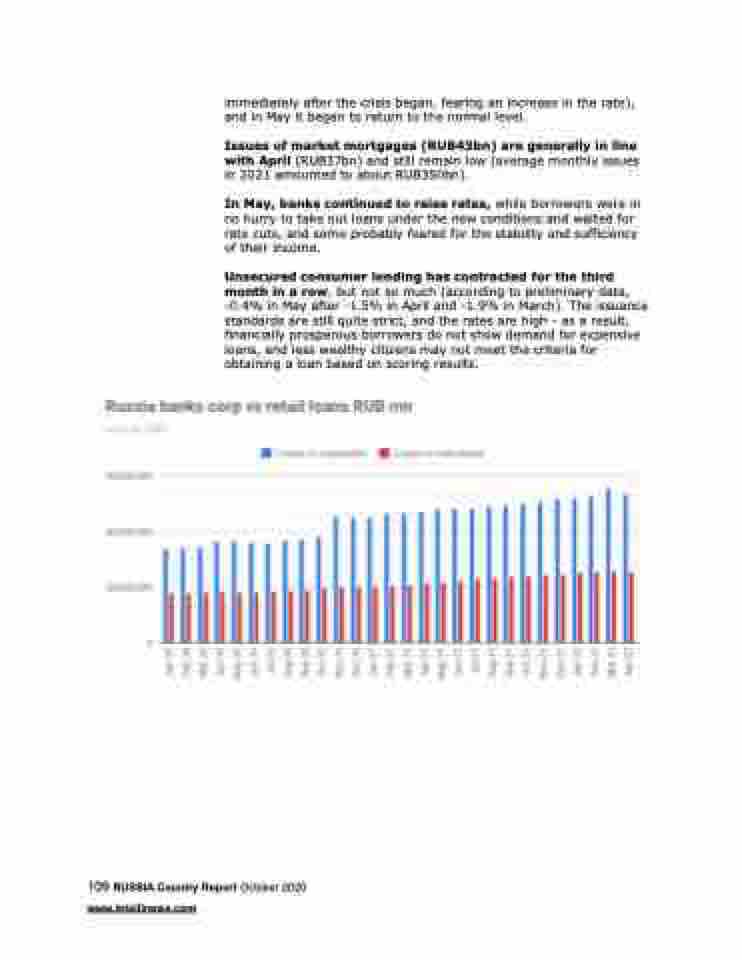

immediately after the crisis began, fearing an increase in the rate), and in May it began to return to the normal level.

Issues of market mortgages (RUB43bn) are generally in line with April (RUB37bn) and still remain low (average monthly issues in 2021 amounted to about RUB350bn).

In May, banks continued to raise rates, while borrowers were in no hurry to take out loans under the new conditions and waited for rate cuts, and some probably feared for the stability and sufficiency of their income.

Unsecured consumer lending has contracted for the third month in a row, but not so much (according to preliminary data, -0.4% in May after -1.5% in April and -1.9% in March). The issuance standards are still quite strict, and the rates are high - as a result, financially prosperous borrowers do not show demand for expensive loans, and less wealthy citizens may not meet the criteria for obtaining a loan based on scoring results.

109 RUSSIA Country Report October 2020 www.intellinews.com