Page 125 - RusRPTJul22

P. 125

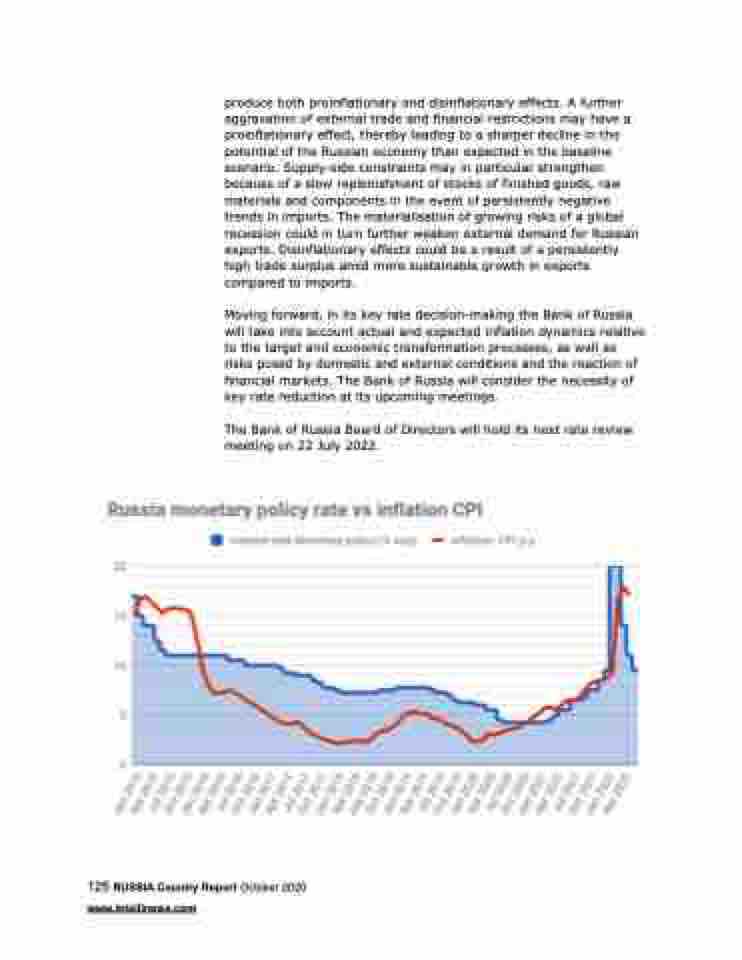

produce both proinflationary and disinflationary effects. A further aggravation of external trade and financial restrictions may have a proinflationary effect, thereby leading to a sharper decline in the potential of the Russian economy than expected in the baseline scenario. Supply-side constraints may in particular strengthen because of a slow replenishment of stocks of finished goods, raw materials and components in the event of persistently negative trends in imports. The materialisation of growing risks of a global recession could in turn further weaken external demand for Russian exports. Disinflationary effects could be a result of a persistently high trade surplus amid more sustainable growth in exports compared to imports.

Moving forward, in its key rate decision-making the Bank of Russia will take into account actual and expected inflation dynamics relative to the target and economic transformation processes, as well as risks posed by domestic and external conditions and the reaction of financial markets. The Bank of Russia will consider the necessity of key rate reduction at its upcoming meetings.

The Bank of Russia Board of Directors will hold its next rate review meeting on 22 July 2022.

125 RUSSIA Country Report October 2020 www.intellinews.com