Page 78 - RusRPTJul22

P. 78

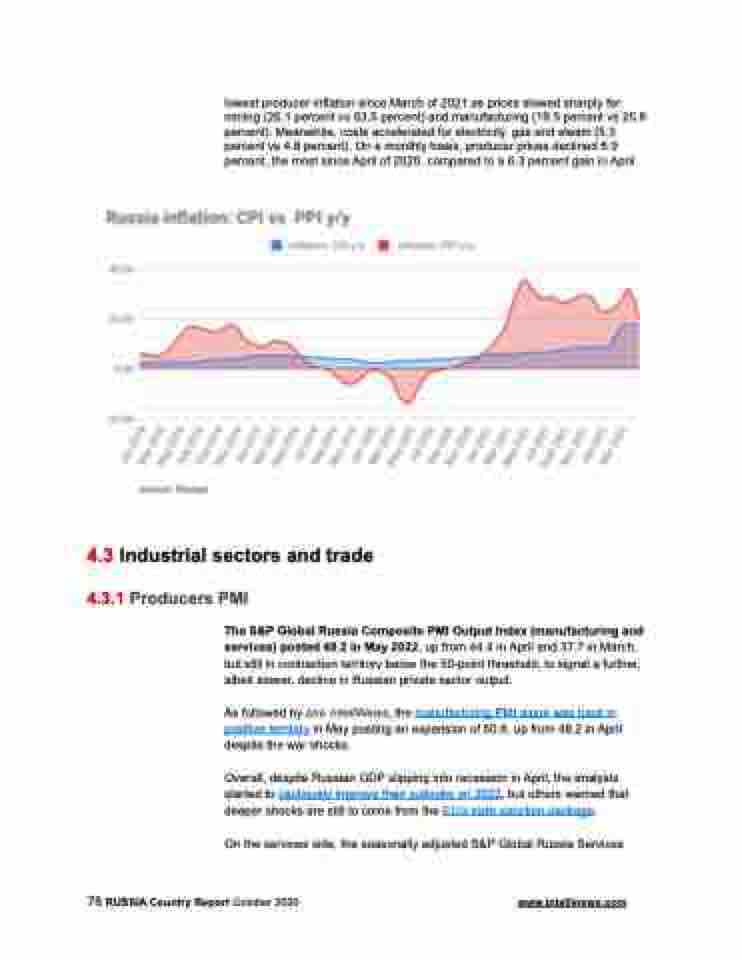

lowest producer inflation since March of 2021 as prices slowed sharply for mining (26.1 percent vs 63.5 percent) and manufacturing (19.5 percent vs 25.8 percent). Meanwhile, costs accelerated for electricity, gas and steam (5.3 percent vs 4.8 percent). On a monthly basis, producer prices declined 6.9 percent, the most since April of 2020, compared to a 6.3 percent gain in April.

4.3 Industrial sectors and trade 4.3.1 Producers PMI

The S&P Global Russia Composite PMI Output Index (manufacturing and services) posted 48.2 in May 2022, up from 44.4 in April and 37.7 in March, but still in contraction territory below the 50-point threshold, to signal a further, albeit slower, decline in Russian private sector output.

As followed by bne IntelliNews, the manufacturing PMI alone was back in positive territory in May posting an expansion of 50.8, up from 48.2 in April despite the war shocks.

Overall, despite Russian GDP slipping into recession in April, the analysts started to cautiously improve their outlooks on 2022, but others warned that deeper shocks are still to come from the EU’s sixth sanction package.

On the services side, the seasonally adjusted S&P Global Russia Services

78 RUSSIA Country Report October 2020 www.intellinews.com