Page 9 - TURKRptJul22

P. 9

As of July 4, Brent was up 45% y/y to $113 while Dutch TTF Natural Gas Futures was higher by 312% y/y.

The Bloomberg Commodity Index (BCOM) was higher by 23% y/y at 117. The USD/Turkish lira (TRY) pair was up 93% y/y to 16.8.

● April 28: The central bank hiked its expectation for end-2022 official inflation to 43% (upper limit: 47%) from the previous figure of 23% given in the January inflation report.

The authority expected inflation to peak at below the 75%-level in May and to fall across the remainder of the year.

The guidance was based on the assumption that the Turkish lira (TRY) will not experience another crash. The USD/TRY is up 14% compared to 14.79 registered on April 28.

● July 28: New quarterly inflation report and updated inflation forecasts will be released.

● August 3: Official inflation for July.

● July 21: Monetary policy committee (MPC) meeting decision at 14h (?) Istanbul time. It is expected to hold its policy rate constant at 14%.

June 23: Hold at 14%.

Turkey’s rate-setting meetings could by now be said to be “no news”

events.

Erdogan has already launched mortgage campaigns at a monthly rate of 0.89%. He also launched commercial loan campaigns at single-digit annual costs.

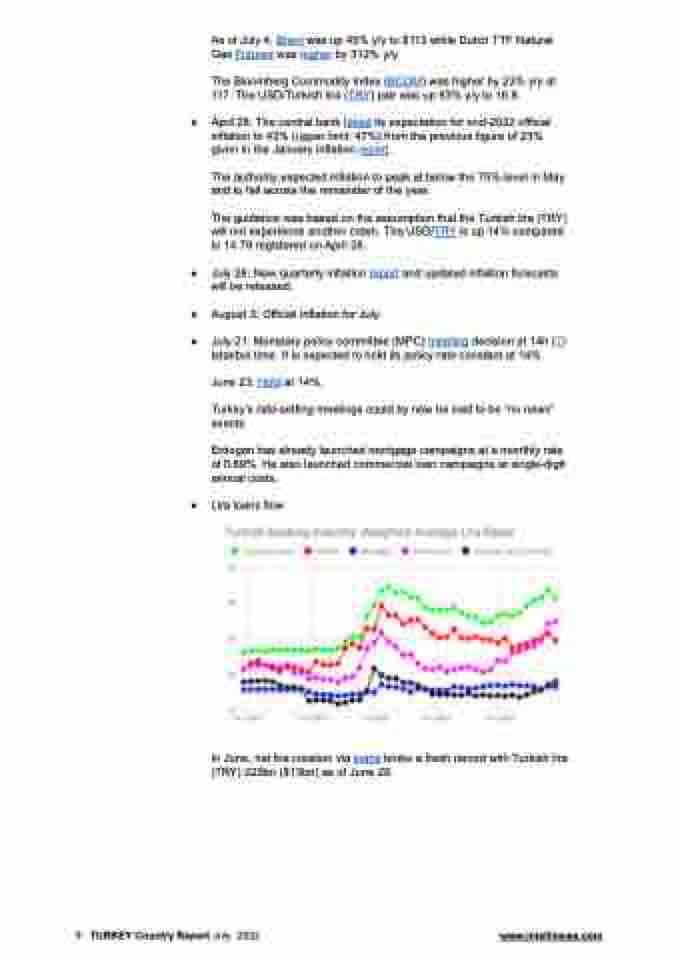

● Lira loans flow

In June, net lira creation via loans broke a fresh record with Turkish lira (TRY) 220bn ($13bn) as of June 29.

9 TURKEY Country Report July 2022 www.intellinews.com