Page 108 - RusRPTSept22

P. 108

opportunity. The minimum lot size will be RUB10,000, while earlier the threshold for entering the segment started at tens of thousands of dollars. Experts warn of the riskiness of such investments. Alfa Investments is the first broker to launch the possibility of retail investment in Russian startups at the pre-IPO stage through a mobile application, Kommersant writes. Access to them is organised through Alfa-Bank's partner, the Rounds investment platform (formerly StartTrack).

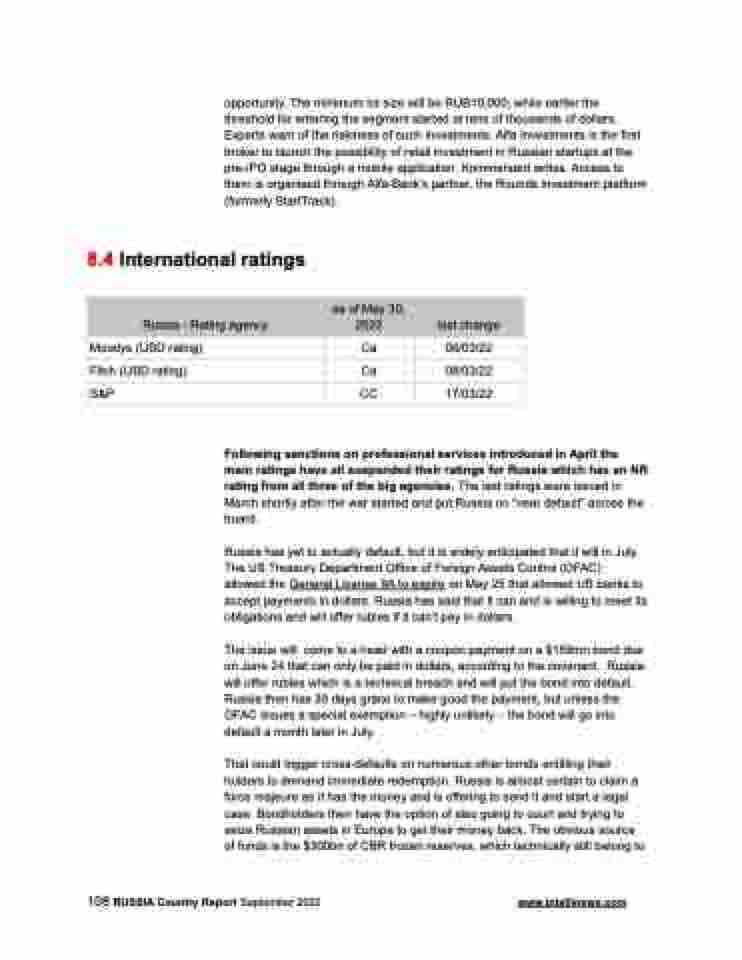

8.4 International ratings

Russia - Rating agency

as of May 30, 2022

last change

Moodys (USD rating)

Ca

06/03/22

Fitch (USD rating)

Ca

08/03/22

S&P

CC

17/03/22

Following sanctions on professional services introduced in April the main ratings have all suspended their ratings for Russia which has an NR rating from all three of the big agencies. The last ratings were issued in March shortly after the war started and put Russia on “near default” across the board.

Russia has yet to actually default, but it is widely anticipated that it will in July. The US Treasury Department Office of Foreign Assets Control (OFAC)

allowed the General License 9A to expire on May 25 that allowed US banks to accept payments in dollars. Russia has said that it can and is willing to meet its obligations and will offer rubles if it can’t pay in dollars.

The issue will come to a head with a coupon payment on a $159mn bond due on June 24 that can only be paid in dollars, according to the covenant. Russia will offer rubles which is a technical breach and will put the bond into default. Russia then has 30 days grace to make good the payment, but unless the OFAC issues a special exemption – highly unlikely – the bond will go into default a month later in July.

That could trigger cross-defaults on numerous other bonds entitling their holders to demand immediate redemption. Russia is almost certain to claim a force majeure as it has the money and is offering to send it and start a legal case. Bondholders then have the option of also going to court and trying to seize Russian assets in Europe to get their money back. The obvious source of funds is the $300bn of CBR frozen reserves, which technically still belong to

108 RUSSIA Country Report September 2022 www.intellinews.com