Page 72 - RusRPTSept22

P. 72

5.0 External Sector & Trade 5.1 External sector overview

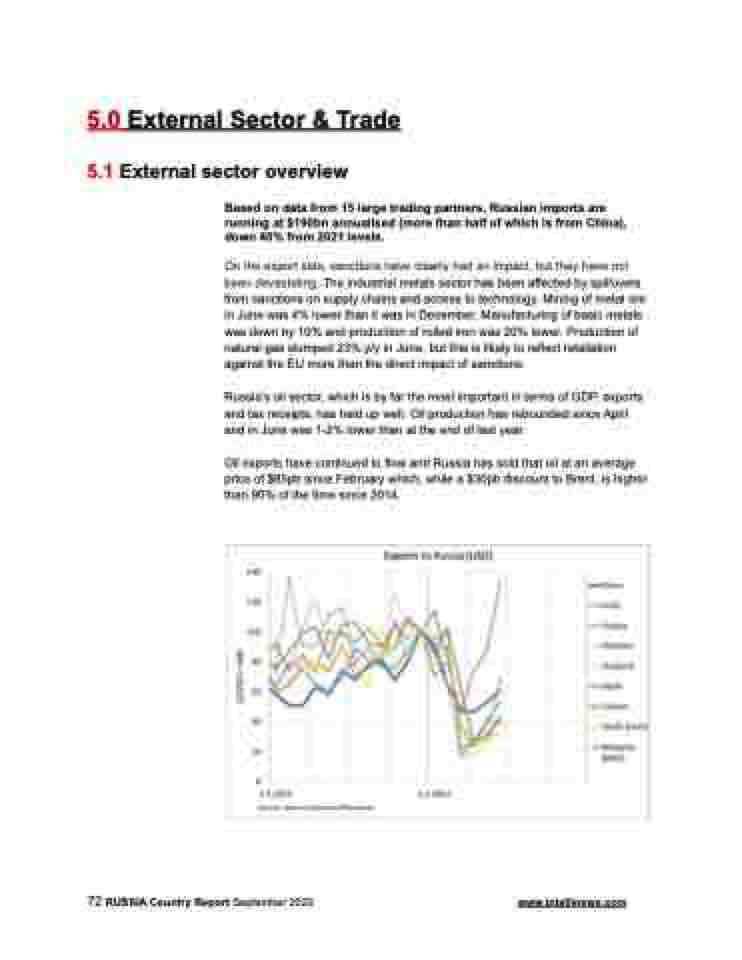

Based on data from 15 large trading partners, Russian imports are running at $190bn annualised (more than half of which is from China), down 40% from 2021 levels.

On the export side, sanctions have clearly had an impact, but they have not been devastating. The industrial metals sector has been affected by spillovers from sanctions on supply chains and access to technology. Mining of metal ore in June was 4% lower than it was in December. Manufacturing of basic metals was down by 10% and production of rolled iron was 20% lower. Production of natural gas slumped 23% y/y in June, but this is likely to reflect retaliation against the EU more than the direct impact of sanctions.

Russia’s oil sector, which is by far the most important in terms of GDP, exports and tax receipts, has held up well. Oil production has rebounded since April and in June was 1-2% lower than at the end of last year.

Oil exports have continued to flow and Russia has sold that oil at an average price of $85pb since February which, while a $30pb discount to Brent, is higher than 90% of the time since 2014.

72 RUSSIA Country Report September 2022 www.intellinews.com