Page 75 - RusRPTSept22

P. 75

trade: exports from Russia to China in the first half of the year were up 48% (mostly energy), while imports from China to Russia increased by just 2.1% (mostly in electronics and engineering products). The figures for the war months are even more stark: in June it was +80% and -17% respectively.

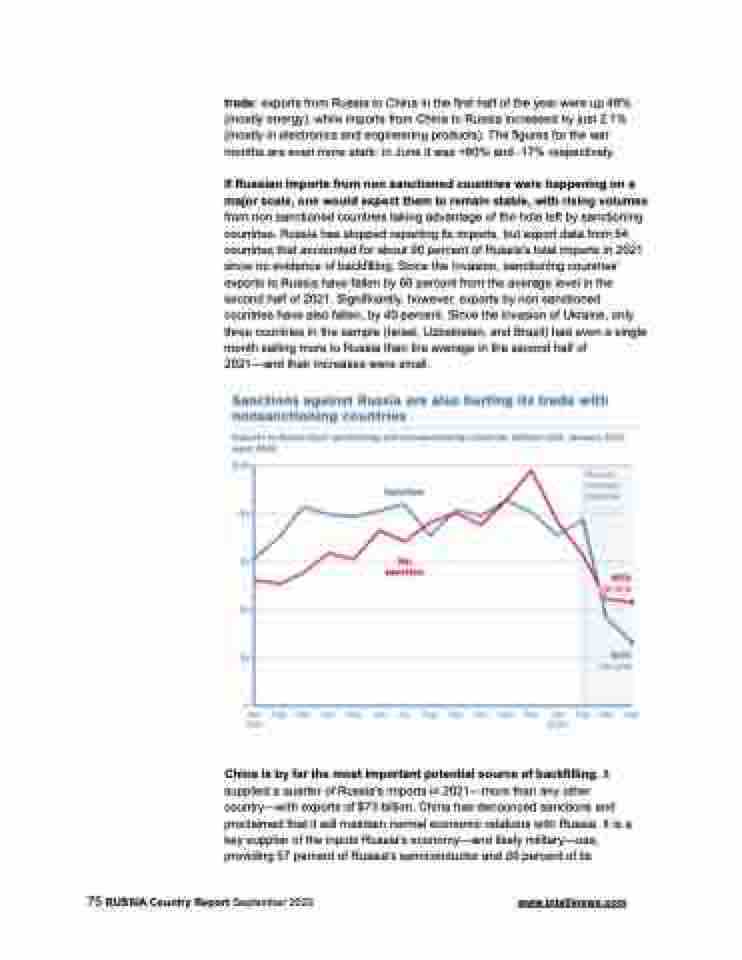

If Russian imports from non sanctioned countries were happening on a major scale, one would expect them to remain stable, with rising volumes from non sanctioned countries taking advantage of the hole left by sanctioning countries. Russia has stopped reporting its imports, but export data from 54 countries that accounted for about 90 percent of Russia's total imports in 2021 show no evidence of backfilling. Since the invasion, sanctioning countries' exports to Russia have fallen by 60 percent from the average level in the second half of 2021. Significantly, however, exports by non sanctioned countries have also fallen, by 40 percent. Since the invasion of Ukraine, only three countries in the sample (Israel, Uzbekistan, and Brazil) had even a single month selling more to Russia than the average in the second half of 2021—and their increases were small.

China is by far the most important potential source of backfilling. It supplied a quarter of Russia's imports in 2021—more than any other country—with exports of $73 billion. China has denounced sanctions and proclaimed that it will maintain normal economic relations with Russia. It is a key supplier of the inputs Russia's economy—and likely military—use, providing 57 percent of Russia's semiconductor and 20 percent of its

75 RUSSIA Country Report September 2022 www.intellinews.com