Page 13 - RusRPTDec22

P. 13

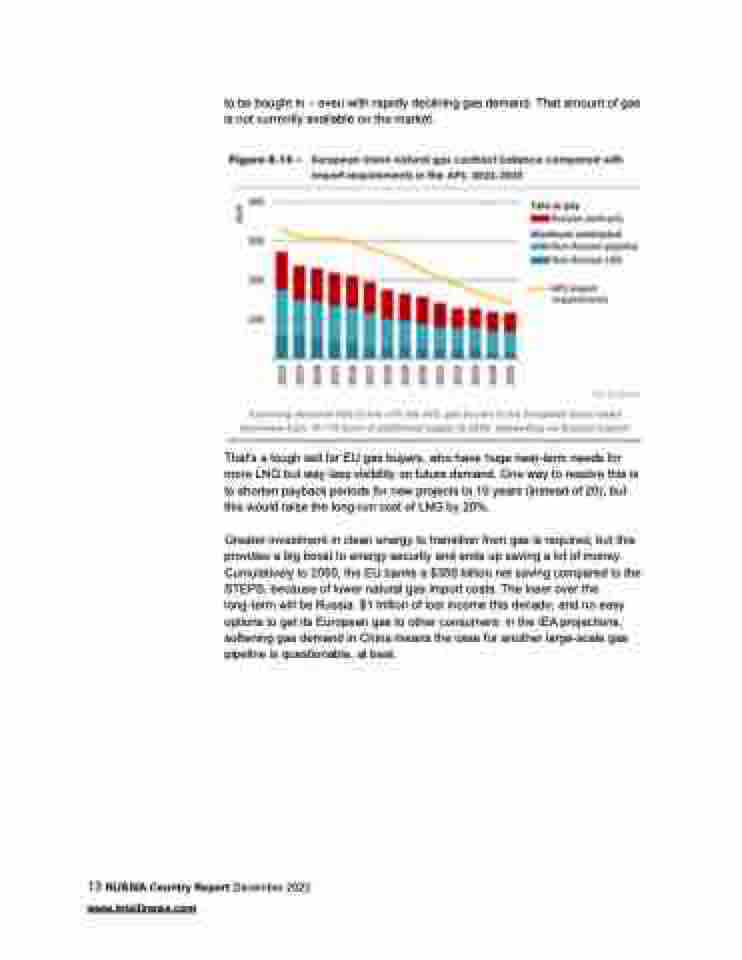

to be bought in – even with rapidly declining gas demand. That amount of gas is not currently available on the market.

That's a tough sell for EU gas buyers, who have huge near-term needs for more LNG but way less visibility on future demand. One way to resolve this is to shorten payback periods for new projects to 10 years (instead of 20), but this would raise the long-run cost of LNG by 20%.

Greater investment in clean energy to transition from gas is required, but this provides a big boost to energy security and ends up saving a lot of money. Cumulatively to 2050, the EU banks a $350 billion net saving compared to the STEPS, because of lower natural gas import costs. The loser over the long-term will be Russia. $1 trillion of lost income this decade, and no easy options to get its European gas to other consumers: in the IEA projections, softening gas demand in China means the case for another large-scale gas pipeline is questionable, at best.

13 RUSSIA Country Report December 2022 www.intellinews.com