Page 68 - RusRPTDec22

P. 68

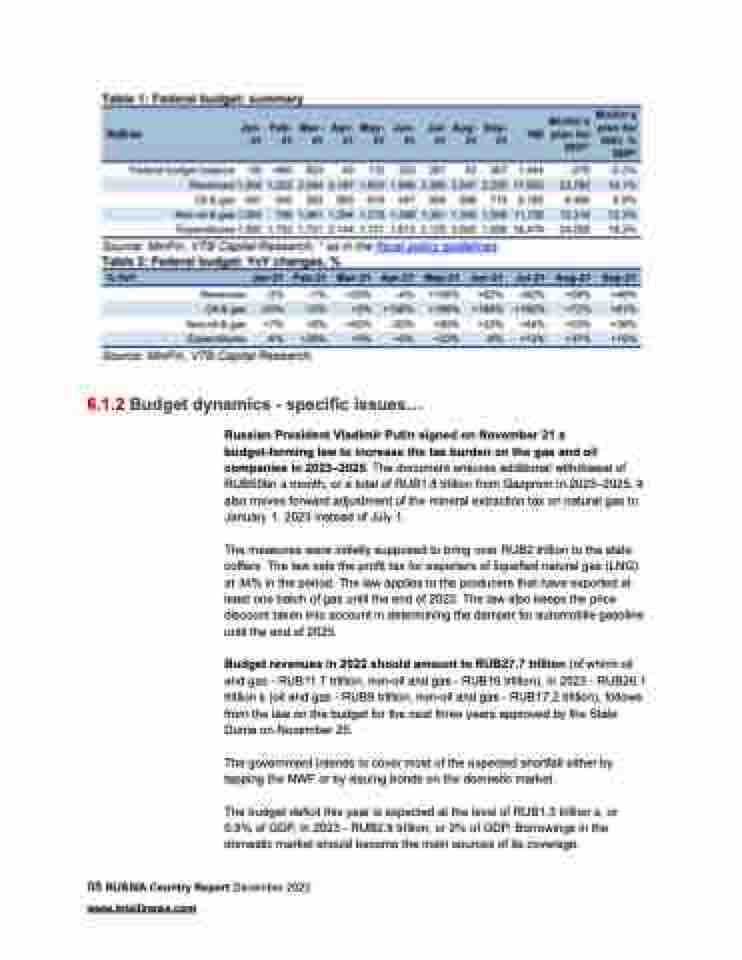

6.1.2 Budget dynamics - specific issues...

Russian President Vladimir Putin signed on November 21 a budget-forming law to increase the tax burden on the gas and oil companies in 2023–2025. The document ensures additional withdrawal of RUB50bn a month, or a total of RUB1.8 trillion from Gazprom in 2023–2025. It also moves forward adjustment of the mineral extraction tax on natural gas to January 1, 2023 instead of July 1.

The measures were initially supposed to bring over RUB2 trillion to the state coffers. The law sets the profit tax for exporters of liquefied natural gas (LNG) at 34% in the period. The law applies to the producers that have exported at least one batch of gas until the end of 2022. The law also keeps the price discount taken into account in determining the damper for automobile gasoline until the end of 2025.

Budget revenues in 2022 should amount to RUB27.7 trillion (of which oil and gas - RUB11.7 trillion, non-oil and gas - RUB16 trillion), in 2023 - RUB26.1 trillion s (oil and gas - RUB9 trillion, non-oil and gas - RUB17.2 trillion), follows from the law on the budget for the next three years approved by the State Duma on November 25.

The government intends to cover most of the expected shortfall either by tapping the NWF or by issuing bonds on the domestic market.

The budget deficit this year is expected at the level of RUB1.3 trillion s, or 0.9% of GDP, in 2023 - RUB2.9 trillion, or 2% of GDP. Borrowings in the domestic market should become the main sources of its coverage.

68 RUSSIA Country Report December 2022 www.intellinews.com