Page 72 - RusRPTDec22

P. 72

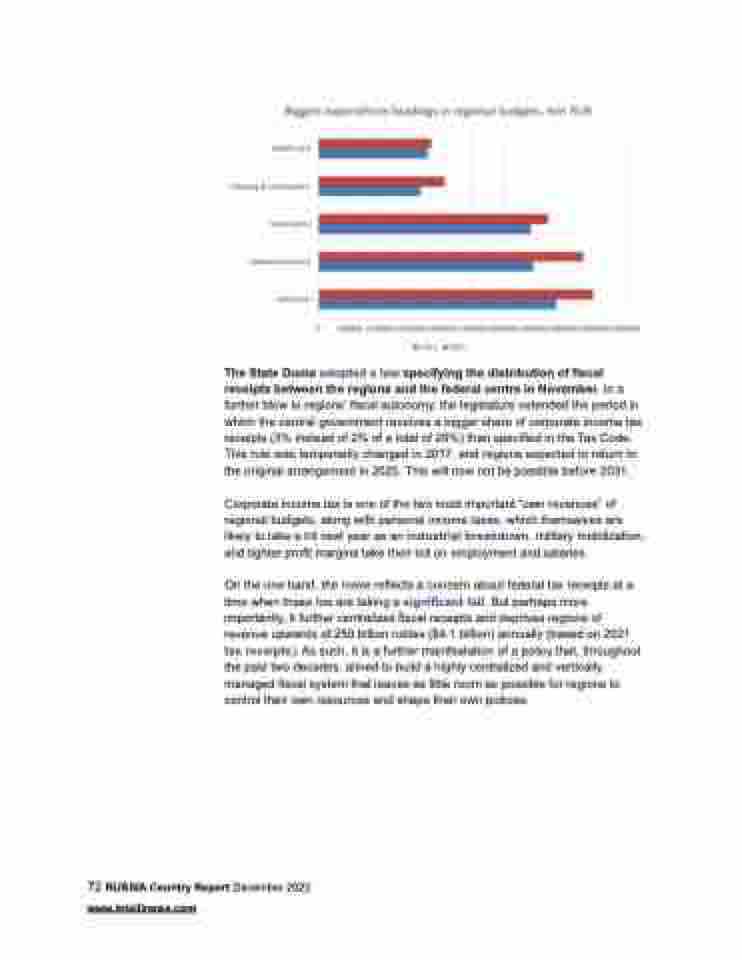

The State Duma adopted a law

Corporate income tax is one of the two most important “own revenues” of regional budgets, along with personal income taxes, which themselves are likely to take a hit next year as an industrial breakdown

On the one hand, the move reflects a concern about federal tax receipts at a time when these too are taking a significant fall

tax receipts

specifying the distribution of fiscal

receipts between the regions and the federal centre in November. In a

further blow to regions’ fiscal autonomy, the legislature extended the period in

which the central government receives a bigger share of corporate income tax

receipts (3% instead of 2% of a total of 20%) than specified in the Tax Code.

This rule was temporarily changed in 2017, and regions expected to return to

the original arrangement in 2025. This will now not be possible before 2031.

, military mobilization,

and tighter profit margins take their toll on employment and salaries.

. But perhaps more

importantly, it further centralizes fiscal receipts and deprives regions of

revenue upwards of 250 billion rubles ($4.1 billion) annually (based on 2021

). As such, it is a further manifestation of a policy that, throughout

the past two decades, aimed to build a highly centralized and vertically

managed fiscal system that leaves as little room as possible for regions to

control their own resources and shape their own policies.

72 RUSSIA Country Report December 2022 www.intellinews.com