Page 84 - RusRPTDec22

P. 84

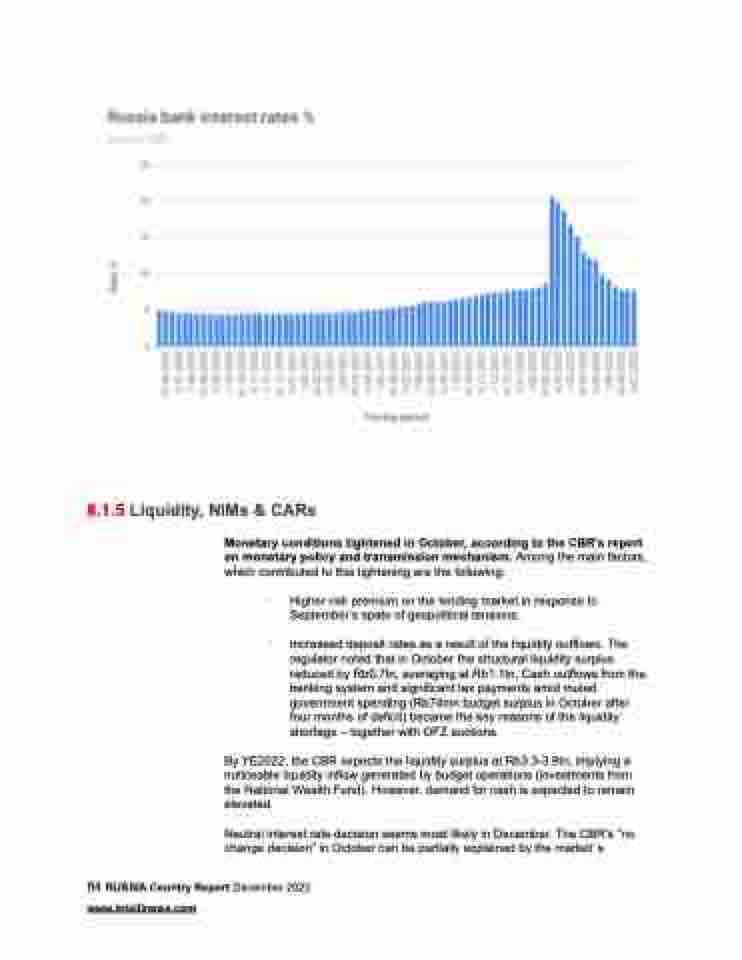

8.1.5 Liquidity, NIMs & CARs

Monetary conditions tightened in October, according to the CBR’s report on monetary policy and transmission mechanism. Among the main factors, which contributed to this tightening are the following:

· Higher risk premium on the lending market in response to September’s spate of geopolitical tensions.

· Increased deposit rates as a result of the liquidity outflows. The regulator noted that in October the structural liquidity surplus reduced by Rb0.7tn, averaging at Rb1.1tn. Cash outflows from the banking system and significant tax payments amid muted government spending (Rb74mn budget surplus in October after four months of deficit) became the key reasons of the liquidity shortage – together with OFZ auctions.

By YE2022, the CBR expects the liquidity surplus at Rb3.3-3.9tn, implying a noticeable liquidity inflow generated by budget operations (investments from the National Wealth Fund). However, demand for cash is expected to remain elevated.

Neutral interest rate decision seems most likely in December. The CBR’s “no change decision” in October can be partially explained by the market’ s

84 RUSSIA Country Report December 2022 www.intellinews.com