Page 116 - RusRPTMar23

P. 116

8.1.2 Loans

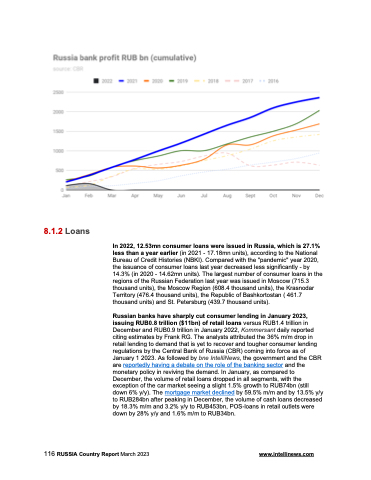

In 2022, 12.53mn consumer loans were issued in Russia, which is 27.1% less than a year earlier (in 2021 - 17.18mn units), according to the National Bureau of Credit Histories (NBKI). Compared with the "pandemic" year 2020, the issuance of consumer loans last year decreased less significantly - by 14.3% (in 2020 - 14.62mn units). The largest number of consumer loans in the regions of the Russian Federation last year was issued in Moscow (715.3 thousand units), the Moscow Region (608.4 thousand units), the Krasnodar Territory (476.4 thousand units), the Republic of Bashkortostan ( 461.7 thousand units) and St. Petersburg (439.7 thousand units).

Russian banks have sharply cut consumer lending in January 2023, issuing RUB0.8 trillion ($11bn) of retail loans versus RUB1.4 trillion in December and RUB0.9 trillion in January 2022, Kommersant daily reported citing estimates by Frank RG. The analysts attributed the 36% m/m drop in retail lending to demand that is yet to recover and tougher consumer lending regulations by the Central Bank of Russia (CBR) coming into force as of January 1 2023. As followed by bne IntelliNews, the government and the CBR are reportedly having a debate on the role of the banking sector and the monetary policy in reviving the demand. In January, as compared to December, the volume of retail loans dropped in all segments, with the exception of the car market seeing a slight 1.5% growth to RUB74bn (still down 6% y/y). The mortgage market declined by 59.5% m/m and by 13.5% y/y to RUB284bn after peaking in December, the volume of cash loans decreased by 18.3% m/m and 3.2% y/y to RUB453bn, POS-loans in retail outlets were down by 28% y/y and 1.6% m/m to RUB34bn.

116 RUSSIA Country Report March 2023 www.intellinews.com