Page 124 - RusRPTMar23

P. 124

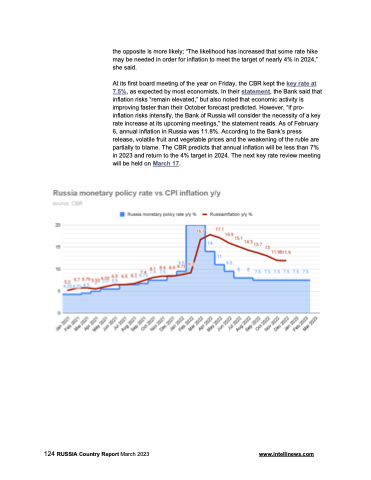

the opposite is more likely; “The likelihood has increased that some rate hike may be needed in order for inflation to meet the target of nearly 4% in 2024,” she said.

At its first board meeting of the year on Friday, the CBR kept the key rate at 7.5%, as expected by most economists. In their statement, the Bank said that inflation risks “remain elevated,” but also noted that economic activity is improving faster than their October forecast predicted. However, “if pro- inflation risks intensify, the Bank of Russia will consider the necessity of a key rate increase at its upcoming meetings,” the statement reads. As of February 6, annual inflation in Russia was 11.8%. According to the Bank’s press release, volatile fruit and vegetable prices and the weakening of the ruble are partially to blame. The CBR predicts that annual inflation will be less than 7% in 2023 and return to the 4% target in 2024. The next key rate review meeting will be held on March 17.

124 RUSSIA Country Report March 2023 www.intellinews.com