Page 129 - RusRPTMar23

P. 129

to sell or receive interest payments on certain investments. Coupon payments to foreign investors holding ruble-denominated sovereign debt, known as OFZs, were frozen, while Russian companies were also barred from paying dividends to overseas shareholders. As restrictions were eased in Autumn last year, foreigners began dumping their OFZ debt, and that process has accelerated in 2023. “A bunch of us took 85% hits when the stuff traded up last year,” Paul McNamara, an emerging markets bond fund manager at London- based GAM, told bne IntelliNews. “I don’t think any real size got done last year, so the big houses still have some.”

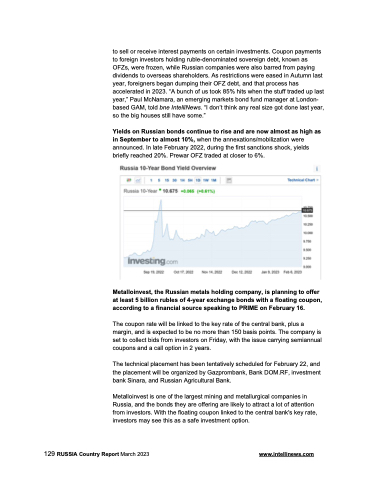

Yields on Russian bonds continue to rise and are now almost as high as in September to almost 10%, when the annexations/mobilization were announced. In late February 2022, during the first sanctions shock, yields briefly reached 20%. Prewar OFZ traded at closer to 6%.

Metalloinvest, the Russian metals holding company, is planning to offer at least 5 billion rubles of 4-year exchange bonds with a floating coupon, according to a financial source speaking to PRIME on February 16.

The coupon rate will be linked to the key rate of the central bank, plus a margin, and is expected to be no more than 150 basis points. The company is set to collect bids from investors on Friday, with the issue carrying semiannual coupons and a call option in 2 years.

The technical placement has been tentatively scheduled for February 22, and the placement will be organized by Gazprombank, Bank DOM.RF, investment bank Sinara, and Russian Agricultural Bank.

Metalloinvest is one of the largest mining and metallurgical companies in Russia, and the bonds they are offering are likely to attract a lot of attention from investors. With the floating coupon linked to the central bank's key rate, investors may see this as a safe investment option.

129 RUSSIA Country Report March 2023 www.intellinews.com