Page 110 - RusRPTApr24

P. 110

primary buyers of new issuances, accounting for approximately 60% of the total volume (155 billion rubles), followed by Non-Bank Financial Institutions (NBFIs) within trust management frameworks (approximately 30%).

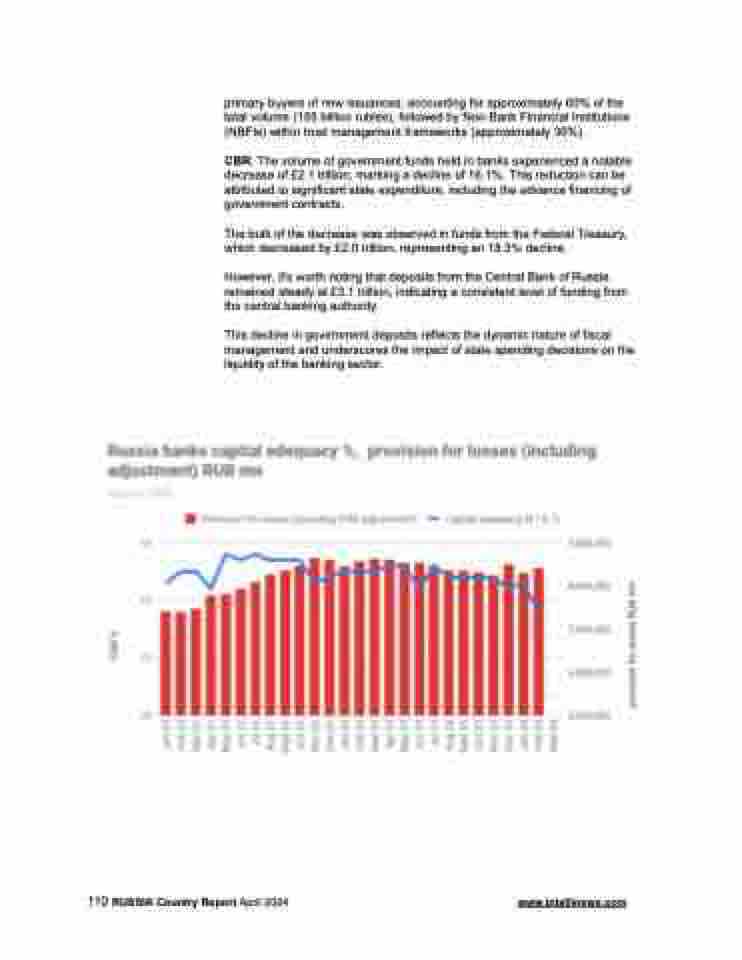

CBR: The volume of government funds held in banks experienced a notable decrease of £2.1 trillion, marking a decline of 16.1%. This reduction can be attributed to significant state expenditure, including the advance financing of government contracts.

The bulk of the decrease was observed in funds from the Federal Treasury, which decreased by £2.0 trillion, representing an 18.3% decline.

However, it's worth noting that deposits from the Central Bank of Russia remained steady at £3.1 trillion, indicating a consistent level of funding from the central banking authority.

This decline in government deposits reflects the dynamic nature of fiscal management and underscores the impact of state spending decisions on the liquidity of the banking sector.

110 RUSSIA Country Report April 2024 www.intellinews.com