Page 72 - RusRPTAug22

P. 72

including transactions concerning the central bank's foreign exchange reserves (the publication of information about which is still suspended in e.g. balance of payments statistics). However, the financial balance deficit was record high in both the first and second quarters of the year (a total of $130bn in January-June). This indicates a significant net outflow of capital from the private sector, as the financial flows of the state and the central bank with foreign countries have generally been relatively small, and as part of the sanctions, Western countries banned transactions with the Russian central bank in March. This year's large deficit in the financial balance has arisen from the fact that a lot of both foreign debts and other corresponding decreasing cash flows and increasing cash flows from foreign receivables have gone abroad.

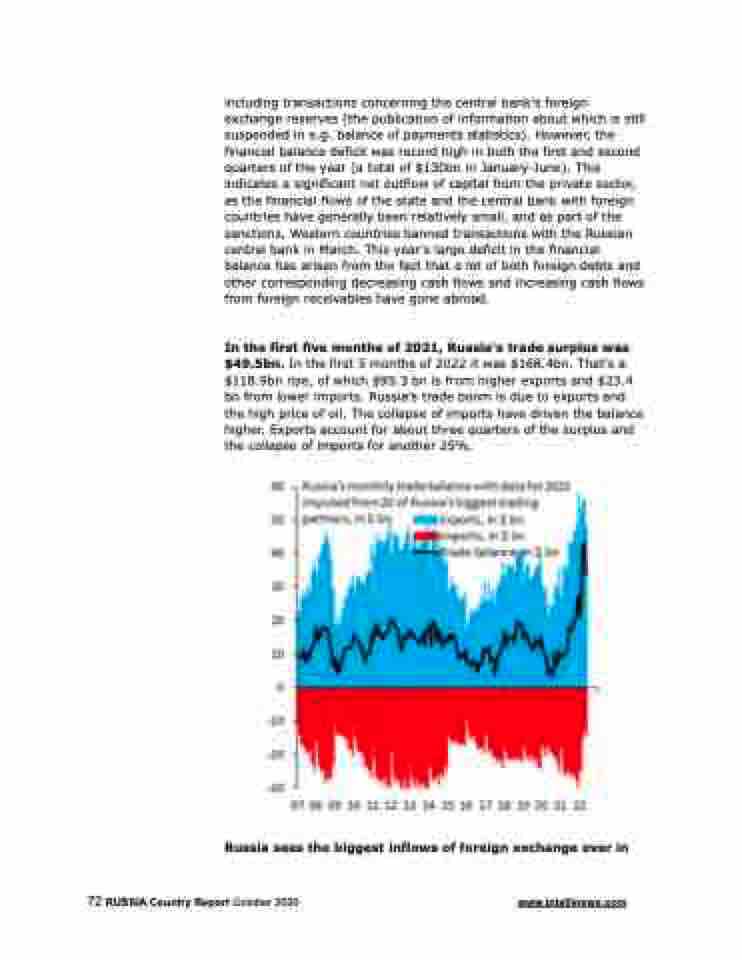

In the first five months of 2021, Russia's trade surplus was $49.5bn. In the first 5 months of 2022 it was $168.4bn. That's a $118.9bn rise, of which $95.3 bn is from higher exports and $23.4 bn from lower imports. Russia's trade boom is due to exports and the high price of oil. The collapse of imports have driven the balance higher. Exports account for about three quarters of the surplus and the collapse of imports for another 25%.

Russia sees the biggest inflows of foreign exchange ever in

72 RUSSIA Country Report October 2020 www.intellinews.com