Page 41 - GEORptSep22

P. 41

8.1.2 Loans

Georgia’s bank loan portfolio grew by 18.7% y/y in June

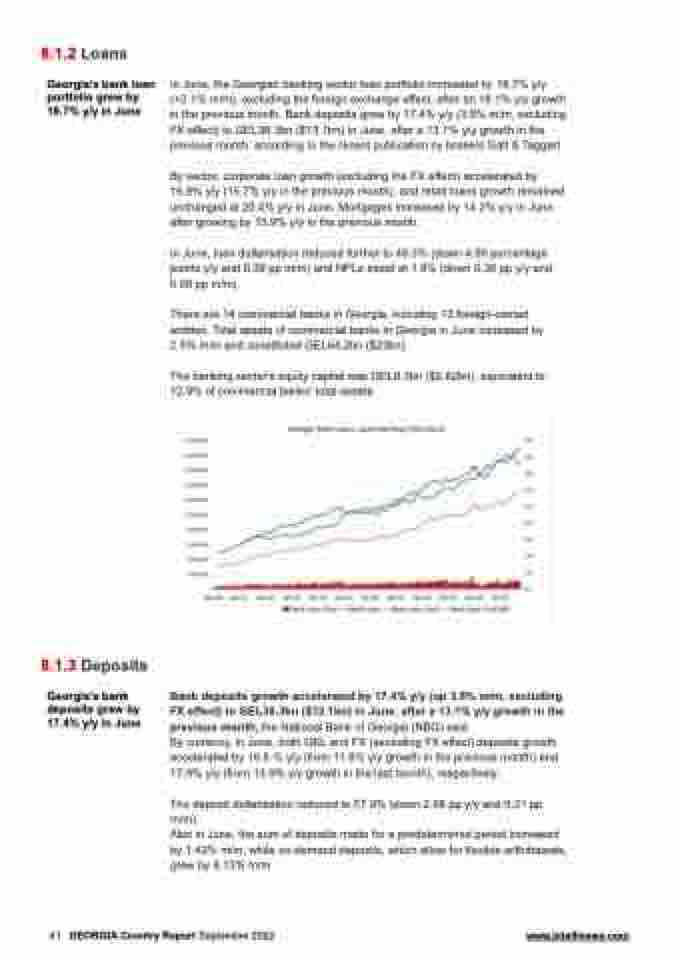

In June, the Georgian banking sector loan portfolio increased by 18.7% y/y (+2.1% m/m), excluding the foreign exchange effect, after an 18.1% y/y growth in the previous month. Bank deposits grew by 17.4% y/y (3.8% m/m, excluding FX effect) to GEL38.3bn ($13.1bn) in June, after a 13.1% y/y growth in the previous month, according to the recent publication by brokers Galt & Taggart.

By sector, corporate loan growth (excluding the FX effect) accelerated by 16.9% y/y (15.7% y/y in the previous month), and retail loans growth remained unchanged at 20.4% y/y in June. Mortgages increased by 14.2% y/y in June after growing by 13.9% y/y in the previous month.

In June, loan dollarisation reduced further to 48.3% (down 4.06 percentage points y/y and 0.39 pp m/m) and NPLs stood at 1.9% (down 0.36 pp y/y and 0.08 pp m/m).

There are 14 commercial banks in Georgia, including 13 foreign-owned entities. Total assets of commercial banks in Georgia in June increased by 2.5% m/m and constituted GEL64.2bn ($23bn).

The banking sector's equity capital was GEL8.3bn ($2.82bn), equivalent to 12.9% of commercial banks' total assets.

8.1.3 Deposits

Georgia’s bank deposits grew by 17.4% y/y in June

Bank deposits growth accelerated by 17.4% y/y (up 3.8% m/m, excluding FX effect) to GEL38.3bn ($13.1bn) in June, after a 13.1% y/y growth in the previous month, the National Bank of Georgia (NBG) said.

By currency, in June, both GEL and FX (excluding FX effect) deposits growth accelerated by 16.6 % y/y (from 11.8% y/y growth in the previous month) and 17.9% y/y (from 13.9% y/y growth in the last month), respectively.

The deposit dollarisation reduced to 57.9% (down 2.08 pp y/y and 0.21 pp m/m).

Also in June, the sum of deposits made for a predetermined period increased by 1.42% m/m, while on-demand deposits, which allow for flexible withdrawals, grew by 4.13% m/m.

41 GEORGIA Country Report September 2022 www.intellinews.com