Page 100 - RusRPTSept23

P. 100

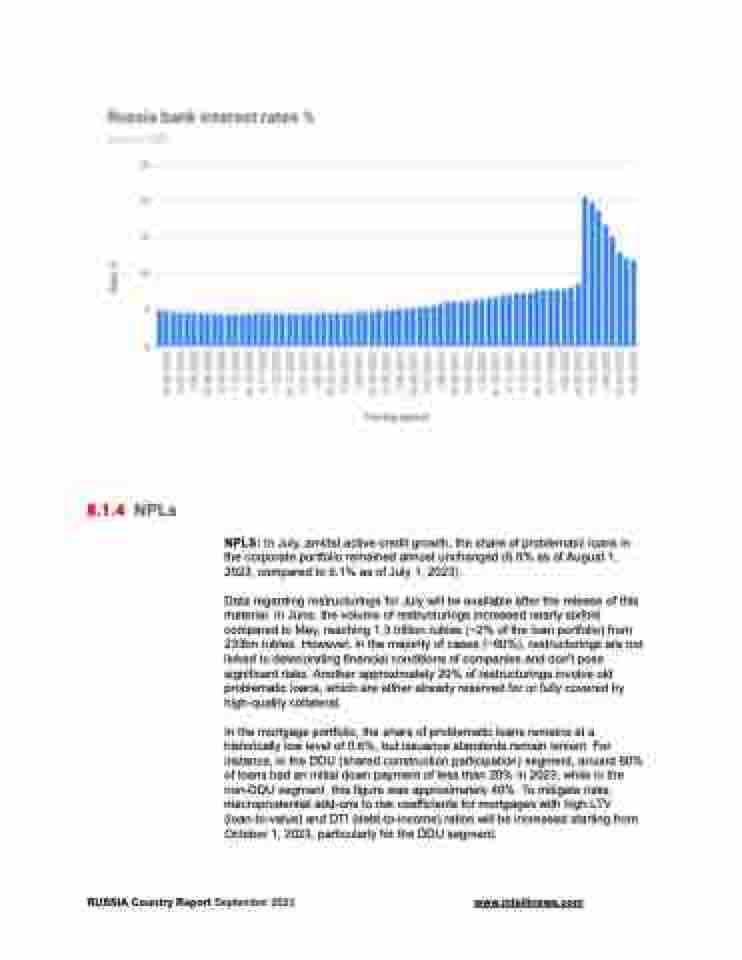

8.1.4 NPLs

NPLS: In July, amidst active credit growth, the share of problematic loans in the corporate portfolio remained almost unchanged (6.0% as of August 1, 2023, compared to 6.1% as of July 1, 2023).

Data regarding restructurings for July will be available after the release of this material. In June, the volume of restructurings increased nearly sixfold compared to May, reaching 1.3 trillion rubles (~2% of the loan portfolio) from 233bn rubles. However, in the majority of cases (~60%), restructurings are not linked to deteriorating financial conditions of companies and don't pose significant risks. Another approximately 20% of restructurings involve old problematic loans, which are either already reserved for or fully covered by high-quality collateral.

In the mortgage portfolio, the share of problematic loans remains at a historically low level of 0.6%, but issuance standards remain lenient. For instance, in the DDU (shared construction participation) segment, around 60% of loans had an initial down payment of less than 20% in 2023, while in the non-DDU segment, this figure was approximately 40%. To mitigate risks, macroprudential add-ons to risk coefficients for mortgages with high LTV (loan-to-value) and DTI (debt-to-income) ratios will be increased starting from October 1, 2023, particularly for the DDU segment.

RUSSIA Country Report September 2023 www.intellinews.com