Page 85 - RusRPTSept23

P. 85

rule in its current form is defective, because it automatically devalues the ruble, its dismantling will not help the national currency much: government signals and the future decision of the Central Bank on the rate are more important.

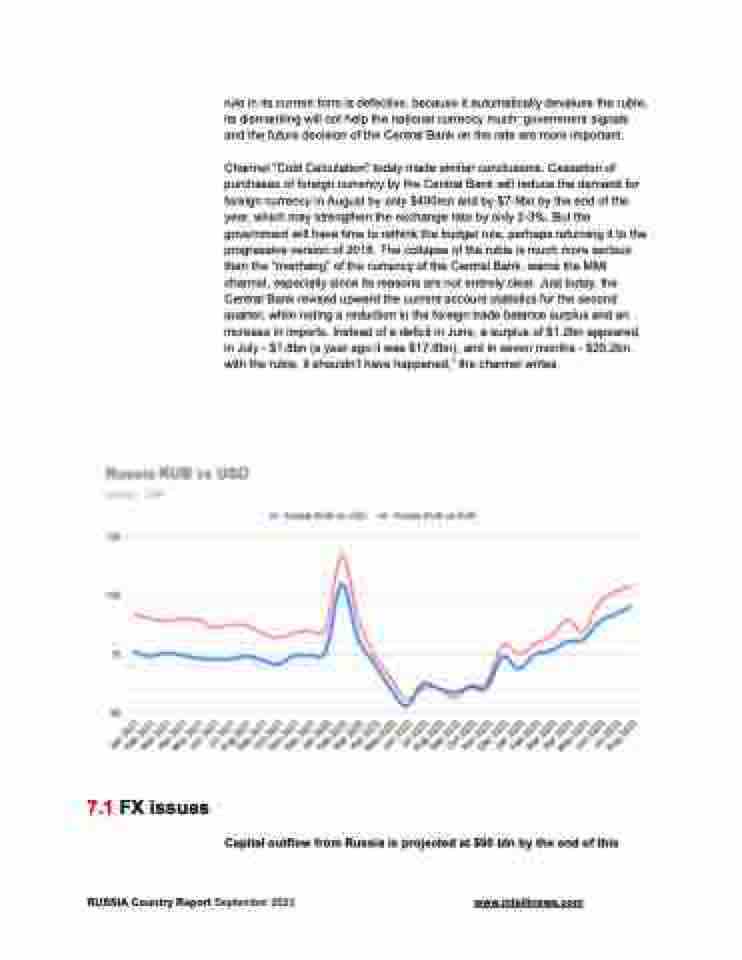

Channel "Cold Calculation" today made similar conclusions. Cessation of purchases of foreign currency by the Central Bank will reduce the demand for foreign currency in August by only $400mn and by $7-9bn by the end of the year, which may strengthen the exchange rate by only 2-3%. But the government will have time to rethink the budget rule, perhaps returning it to the progressive version of 2018. The collapse of the ruble is much more serious than the “overhang” of the currency of the Central Bank, warns the MMI channel, especially since its reasons are not entirely clear. Just today, the Central Bank revised upward the current account statistics for the second quarter, while noting a reduction in the foreign trade balance surplus and an increase in imports. Instead of a deficit in June, a surplus of $1.2bn appeared, in July - $1.8bn (a year ago it was $17.8bn), and in seven months - $25.2bn. with the ruble, it shouldn’t have happened,” the channel writes.

7.1 FX issues

Capital outflow from Russia is projected at $90 bln by the end of this

RUSSIA Country Report September 2023 www.intellinews.com