Page 91 - RusRPTSept23

P. 91

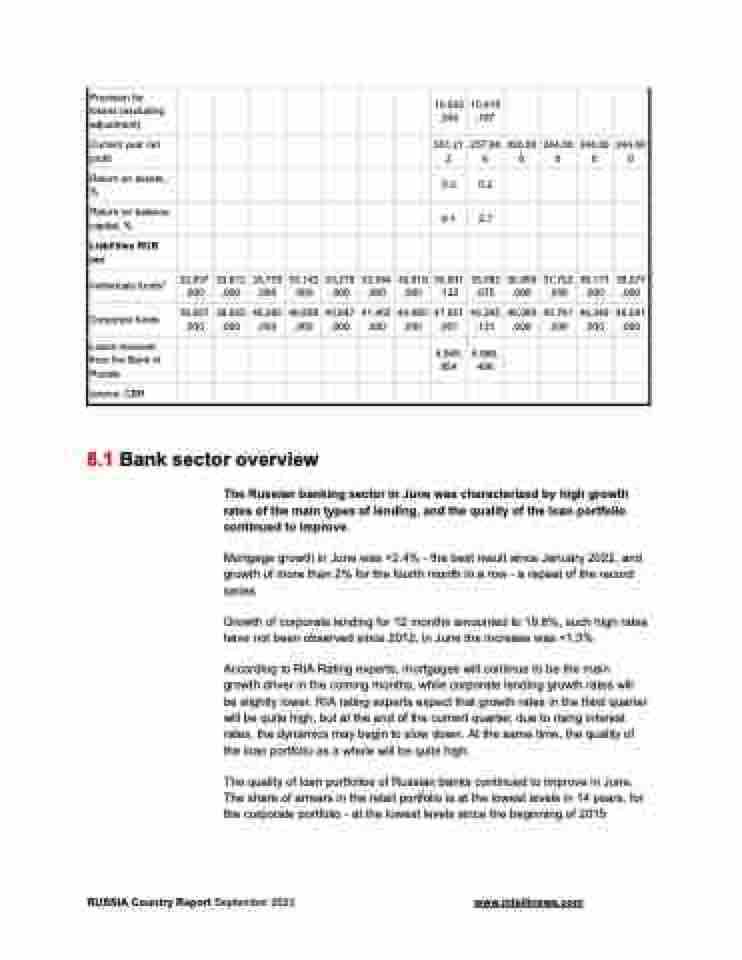

Provision for losses (excluding adjustment)

10,542 ,346

10,418 ,767

Current year net profit

551,21 2

257,98 6

330,00 0

244,00 0

244,00 0

244,00 0

Return on assets, %

0.5

0.2

Return on balance capital, %

6.1

2.7

Liabilities RUB mn

Individuals funds*

32,937 ,000

33,812 ,000

33,779 ,000

33,142 ,000

33,279 ,000

33,564 ,000

36,619 ,000

36,601 ,123

35,582 ,075

36,956 ,000

37,722 ,000

38,173 ,000

39,277 ,000

Corporate funds

36,657 ,000

38,655 ,000

40,265 ,000

40,808 ,000

40,847 ,000

41,465 ,000

44,980 ,000

47,621 ,951

46,345 ,131

46,089 ,000

45,781 ,000

46,349 ,000

46,581 ,000

Loans received from the Bank of Russia

4,949, 854

4,566, 408

source: CBR

8.1 Bank sector overview

The Russian banking sector in June was characterized by high growth rates of the main types of lending, and the quality of the loan portfolio continued to improve.

Mortgage growth in June was +2.4% - the best result since January 2022, and growth of more than 2% for the fourth month in a row - a repeat of the record series

Growth of corporate lending for 12 months amounted to 19.8%, such high rates have not been observed since 2012, in June the increase was +1.3%

According to RIA Rating experts, mortgages will continue to be the main growth driver in the coming months, while corporate lending growth rates will be slightly lower. RIA rating experts expect that growth rates in the third quarter will be quite high, but at the end of the current quarter, due to rising interest rates, the dynamics may begin to slow down. At the same time, the quality of the loan portfolio as a whole will be quite high.

The quality of loan portfolios of Russian banks continued to improve in June. The share of arrears in the retail portfolio is at the lowest levels in 14 years, for the corporate portfolio - at the lowest levels since the beginning of 2015

RUSSIA Country Report September 2023 www.intellinews.com