Page 136 - RusRPTNov22

P. 136

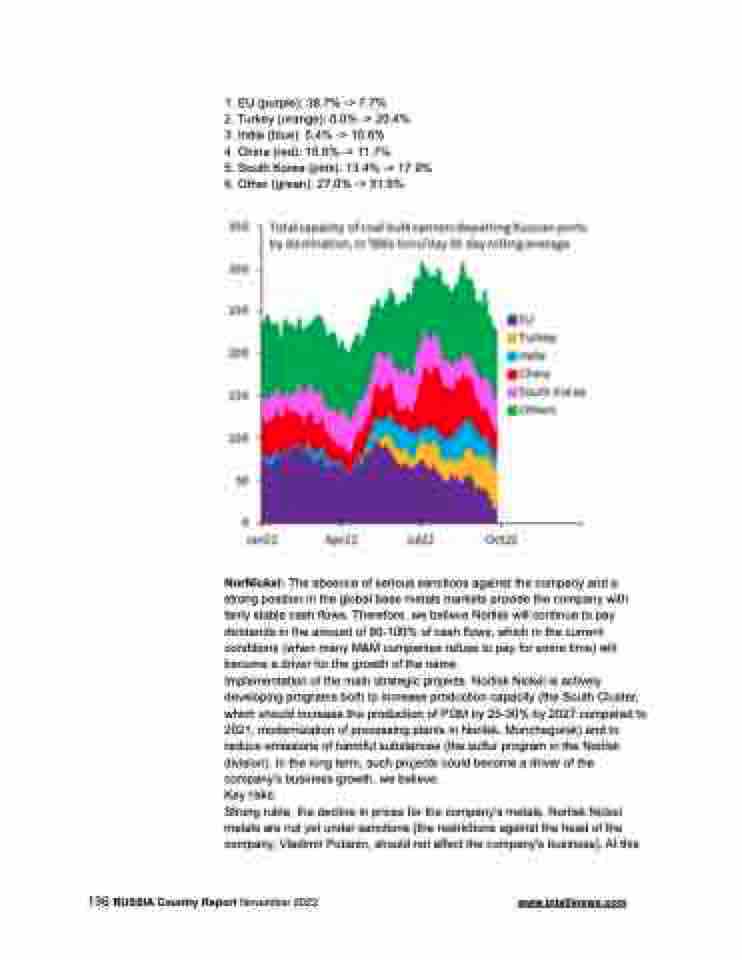

1. EU (purple): 38.7% -> 7.7%

2. Turkey (orange): 0.0% -> 20.4%

3. India (blue): 5.4% -> 10.6%

4. China (red): 15.6% -> 11.7%

5. South Korea (pink): 13.4% -> 17.9% 6. Other (green): 27.0% -> 31.9%

NorNickel: The absence of serious sanctions against the company and a strong position in the global base metals markets provide the company with fairly stable cash flows. Therefore, we believe Norilsk will continue to pay dividends in the amount of 80-100% of cash flows, which in the current conditions (when many M&M companies refuse to pay for some time) will become a driver for the growth of the name.

Implementation of the main strategic projects. Norilsk Nickel is actively developing programs both to increase production capacity (the South Cluster, which should increase the production of PGM by 25-30% by 2027 compared to 2021; modernization of processing plants in Norilsk, Monchegorsk) and to reduce emissions of harmful substances (the sulfur program in the Norilsk division). In the long term, such projects could become a driver of the company's business growth, we believe.

Key risks

Strong ruble, the decline in prices for the company's metals. Norilsk Nickel metals are not yet under sanctions (the restrictions against the head of the company, Vladimir Potanin, should not affect the company's business). At this

136 RUSSIA Country Report November 2022 www.intellinews.com