Page 21 - RusRPTNov22

P. 21

gas, as bne IntelliNews reported was likely to happen in an article on oil and gas leakage to the sanctions regime.

“Reporting in recent months has indicated this practice has already become commonplace, with smaller ships often travelling to international waters in the Atlantic Ocean to transfer Russian crude to larger, more efficient ships to onward shipments to Asia,” BCS GM reports.

Analysts remain very sceptical that either the oil or gas price caps can be made to work thanks to the already existent leakages in the sanctions regime.

“We think both policies – blocking insurance and the price cap – are very unlikely to succeed. The first can be gotten around by determined buyers, and the current c$20 per barrel Urals discount provides a significant $80mn per day of such incentive,” says BCS GM.

Analysts also speculate that any attempt to impose the price caps will lead to a retaliation by the Kremlin, which would make good on its threat to simply cut buyers off from supplies and that will lead to both a supply and price shock.

“The second will simply not be adhered to by Russia and attempts to enforce price caps will see Russian exports drop and, most likely, international oil prices rise materially,” BCS GM added.

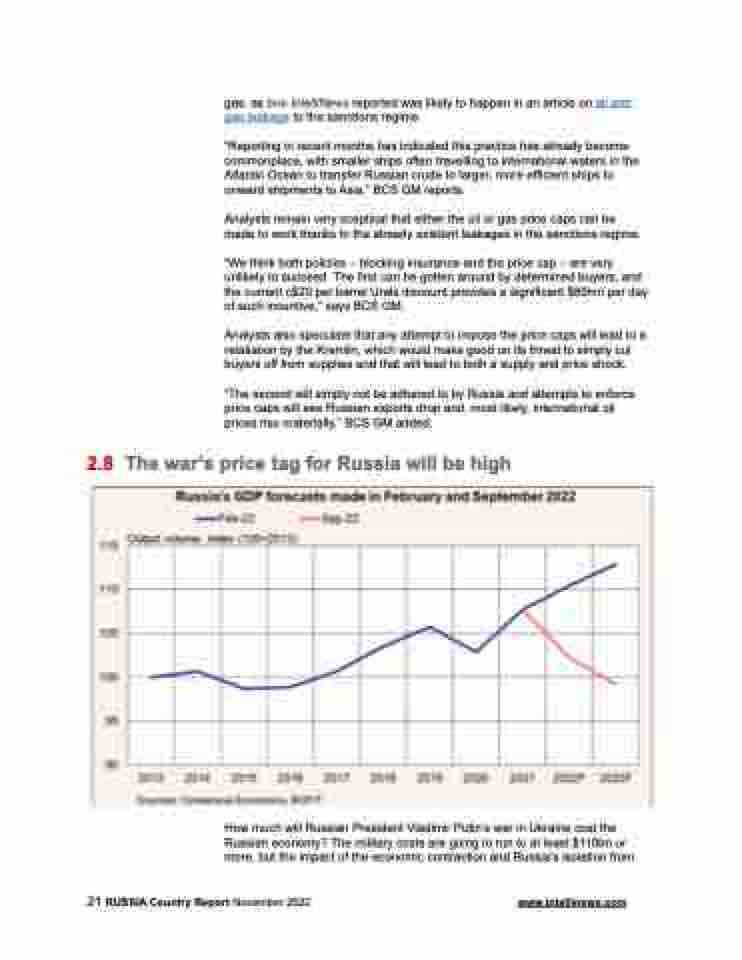

2.8 The war’s price tag for Russia will be high

How much will Russian President Vladimir Putin’s war in Ukraine cost the Russian economy? The military costs are going to run to at least $110bn or more, but the impact of the economic contraction and Russia’s isolation from

21 RUSSIA Country Report November 2022 www.intellinews.com