Page 42 - RusRPTNov22

P. 42

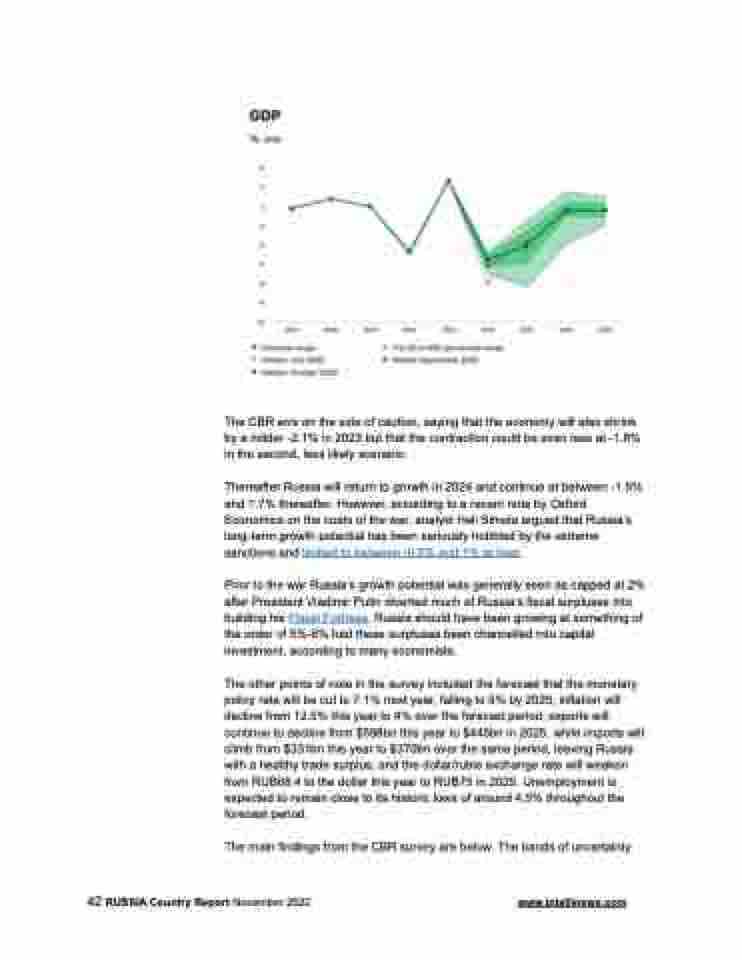

The CBR errs on the side of caution, saying that the economy will also shrink by a milder -2.1% in 2023 but that the contraction could be even less at -1.8% in the second, less likely scenario.

Thereafter Russia will return to growth in 2024 and continue at between -1.5% and 1.7% thereafter. However, according to a recent note by Oxford Economics on the costs of the war, analyst Heli Simola argued that Russia’s long-term growth potential has been seriously hobbled by the extreme sanctions and limited to between -0.5% and 1% at best.

Prior to the war Russia’s growth potential was generally seen as capped at 2% after President Vladimir Putin diverted much of Russia’s fiscal surpluses into building his Fiscal Fortress. Russia should have been growing at something of the order of 5%-6% had these surpluses been channelled into capital investment, according to many economists.

The other points of note in the survey included the forecast that the monetary policy rate will be cut to 7.1% next year, falling to 6% by 2025; inflation will decline from 12.5% this year to 4% over the forecast period; exports will continue to decline from $598bn this year to $445bn in 2025, while imports will climb from $331bn this year to $370bn over the same period, leaving Russia with a healthy trade surplus; and the dollar/ruble exchange rate will weaken from RUB68.4 to the dollar this year to RUB75 in 2025. Unemployment is expected to remain close to its historic lows of around 4.5% throughout the forecast period.

The main findings from the CBR survey are below. The bands of uncertainty

42 RUSSIA Country Report November 2022 www.intellinews.com