Page 73 - RusRPTNov22

P. 73

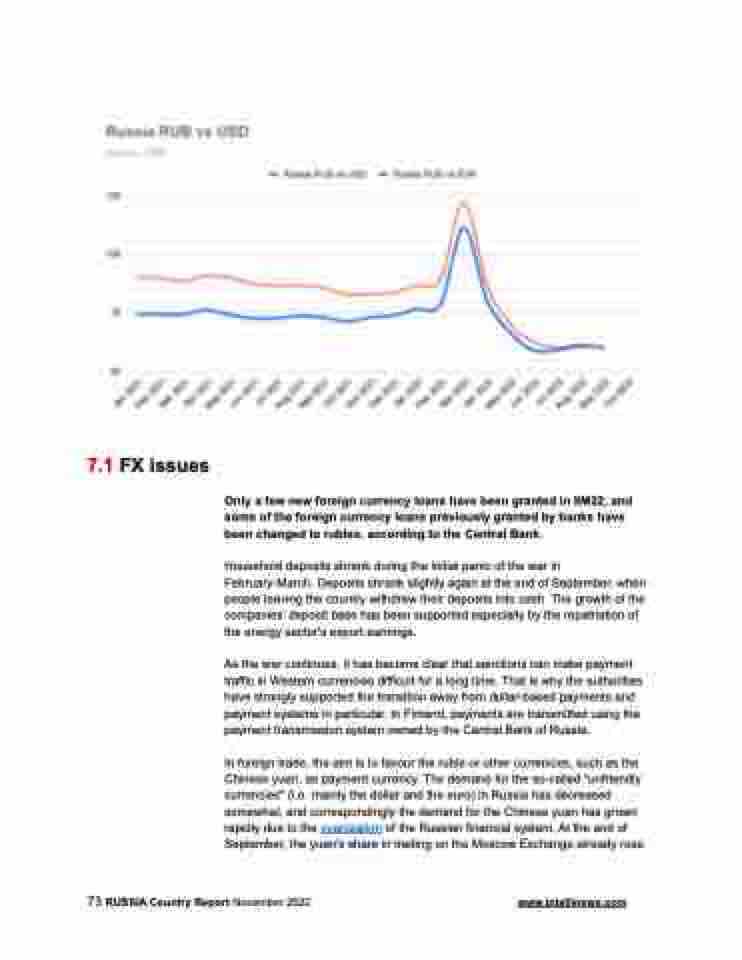

7.1 FX issues

Only a few new foreign currency loans have been granted in 9M22, and some of the foreign currency loans previously granted by banks have been changed to rubles, according to the Central Bank.

Household deposits shrank during the initial panic of the war in February-March. Deposits shrank slightly again at the end of September, when people leaving the country withdrew their deposits into cash. The growth of the companies' deposit base has been supported especially by the repatriation of the energy sector's export earnings.

As the war continues, it has become clear that sanctions can make payment traffic in Western currencies difficult for a long time. That is why the authorities have strongly supported the transition away from dollar-based payments and payment systems in particular. In Finland, payments are transmitted using the payment transmission system owned by the Central Bank of Russia.

In foreign trade, the aim is to favour the ruble or other currencies, such as the Chinese yuan, as payment currency. The demand for the so-called "unfriendly currencies" (i.e. mainly the dollar and the euro) in Russia has decreased somewhat, and correspondingly the demand for the Chinese yuan has grown rapidly due to the yuanization of the Russian financial system. At the end of September, the yuan's share in trading on the Moscow Exchange already rose

73 RUSSIA Country Report November 2022 www.intellinews.com