Page 88 - RusRPTNov22

P. 88

8.3 Stock market

8.3.1 Equity market dynamics

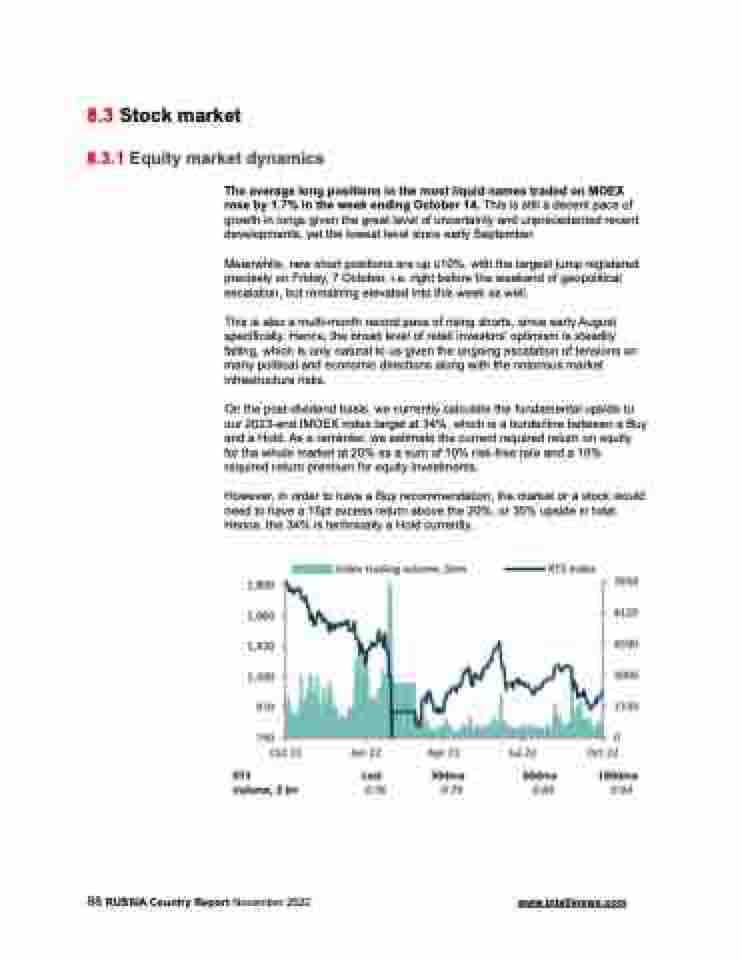

The average long positions in the most liquid names traded on MOEX rose by 1.7% in the week ending October 14. This is still a decent pace of growth in longs given the great level of uncertainty and unprecedented recent developments, yet the lowest level since early September.

Meanwhile, new short positions are up c10%, with the largest jump registered precisely on Friday, 7 October, i.e. right before the weekend of geopolitical escalation, but remaining elevated into this week as well.

This is also a multi-month record pace of rising shorts, since early August specifically. Hence, the broad level of retail investors’ optimism is steadily falling, which is only natural to us given the ongoing escalation of tensions on many political and economic directions along with the notorious market infrastructure risks.

On the post-dividend basis, we currently calculate the fundamental upside to our 2023-end IMOEX index target at 34%, which is a borderline between a Buy and a Hold. As a reminder, we estimate the current required return on equity for the whole market at 20% as a sum of 10% risk-free rate and a 10% required return premium for equity investments.

However, in order to have a Buy recommendation, the market or a stock would need to have a 15pt excess return above the 20%, or 35% upside in total. Hence, the 34% is technically a Hold currently.

88 RUSSIA Country Report November 2022 www.intellinews.com