Page 72 - TURKRptJun22

P. 72

72 Opinion bne June 2022

The war in Ukraine will have wide reaching effects on all the Emerging Markets. Photo: wiki

How will the war in Ukraine affect Emerging Markets?

Les Nemethy CEO and founder of Euro-Phoenix Financial Advisors

We have all heard the adage that a butterfly flapping its wings in the Amazon could affect the weather patterns on the other side of the planet. Might the war in Ukraine also have such unintended consequences?

While I despair at the scale of the humanitarian disaster in Ukraine, this article explores the possibility of unexpected and unforeseeable effects beyond Ukraine's borders, including the possibility of more people dying of starvation in other parts of the world rather than as a consequence of military action in Ukraine.

The three main possible transmission mechanisms for this butterfly effect include: (a) disruption of supply chains, particularly in agriculture; (b) energy supply disruptions and (c) monetary effects. These trends often reinforce each other. All were already underway before the war; the war seems to have aggravated and catalysed these effects.

Disruption of supply chains, particularly in agriculture

Global supply chains were already under strain, independent of the Ukrainian war, partly due to coronavirus (COVID-19). For example, 30% of the world’s containers are now at a

www.bne.eu

standstill, waiting around ports, due to the disruption, with most of them stuck near Shanghai, locked down by COVID.

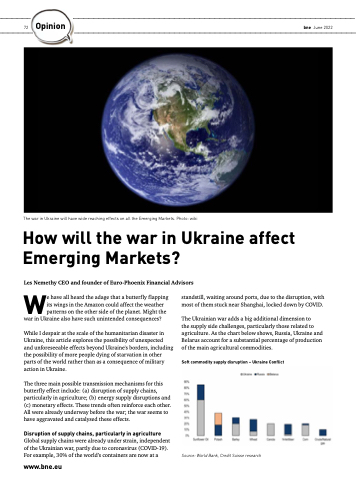

The Ukrainian war adds a big additional dimension to

the supply side challenges, particularly those related to agriculture. As the chart below shows, Russia, Ukraine and Belarus account for a substantial percentage of production of the main agricultural commodities.

Soft commodity supply disruption – Ukraine Conflict

Source: World Bank, Credit Suisse research