Page 78 - TURKRptJun22

P. 78

78 Opinion bne June 2022

ISTANBUL BLOG

With official inflation a hair’s breadth from 70%, Turkey is on the tail of Zimbabwe

Akin Nazli in Belgrade

Turkey’s official consumer price index (CPI) inflation in April amounted to 69.97% y/y in April, following on from the 61.14% reported for March, the Turkish Statistical Institute (TUIK, or TurkStat) said on May 5.

The April figure (presented with great discipline as 69.97% rather than 70% by officials), marked the highest headline inflation recorded by Turkey since the 73% posted in February 2002.

At 69.97%, Turkey left Suriname behind in the global inflation league. Turkey’s next rival is Zimbabwe, which took fifth place in April with 96%.

The ENAG research group, an Istanbul-based outfit led by academics that provides independent assessments of where Turkey's inflation actually stands, calculated that CPI inflation in April was 157% y/y, following on from 143% in March.

TUIK, meanwhile, gave an official figure of 122% y/y for producer price index (PPI) inflation in April, up from 115% in March.

On April 28, the central bank hiked its expectation for end- 2022 official inflation to 43% from the prediction of 23% it presented in its January inflation report.

The upper limit on the official inflation forecast was also moved up, taking the expectation to 47% from 28%.

The authority expects official inflation to peak at below the 75%-level in May and to fall across the remainder of the year.

The guidance is based on the assumption that the Turkish lira (TRY) will not experience another crash.

Turkey’s central bank currently serves as a lira printing house and as an accounting department for the palace administration.

The country’s monetary policy is absolutely inefficient and makes no sense at all. The central bank, working on the leash of President Recep Tayyip Erdogan, has no impact on monetary policy and its policy rate has no impact on market rates.

The war in Ukraine is a “new normal” for the markets now. But relative stabilisation in commodity prices (compared to

www.bne.eu

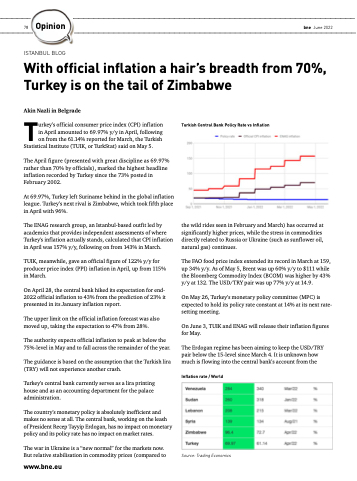

Turkish Central Bank Policy Rate vs Inflation

the wild rides seen in February and March) has occurred at significantly higher prices, while the stress in commodities directly related to Russia or Ukraine (such as sunflower oil, natural gas) continues.

The FAO food price index extended its record in March at 159, up 34% y/y. As of May 5, Brent was up 60% y/y to $111 while the Bloomberg Commodity Index (BCOM) was higher by 43% y/y at 132. The USD/TRY pair was up 77% y/y at 14.9.

On May 26, Turkey’s monetary policy committee (MPC) is expected to hold its policy rate constant at 14% at its next rate- setting meeting.

On June 3, TUIK and ENAG will release their inflation figures for May.

The Erdogan regime has been aiming to keep the USD/TRY pair below the 15-level since March 4. It is unknown how much is flowing into the central bank’s account from the

Inflation rate / World

Source: Trading Economics