Page 82 - TURKRptJun22

P. 82

82 I New Europe in Numbers bne June 2022

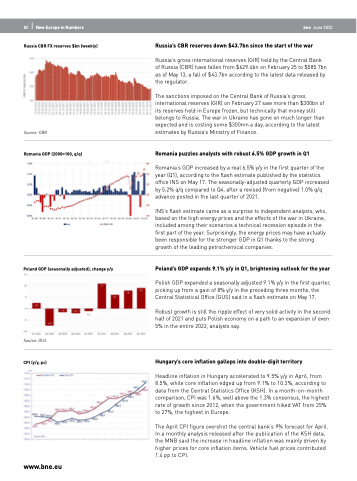

Russia CBR FX reserves $bn (weekly)

Russia’s CBR reserves down $43.7bn since the start of the war

Source: CBR

Romania GDP (2000=100, q/q)

Russia’s gross international reserves (GIR) held by the Central Bank of Russia (CBR) have fallen from $629.4bn on February 25 to $585.7bn as of May 13, a fall of $43.7bn according to the latest data released by the regulator.

The sanctions imposed on the Central Bank of Russia’s gross international reserves (GIR) on February 27 saw more than $300bn of its reserves held in Europe frozen, but technically that money still belongs to Russia. The war in Ukraine has gone on much longer than expected and is costing some $300mn a day, according to the latest estimates by Russia’s Ministry of Finance.

Romania puzzles analysts with robust 6.5% GDP growth in Q1

Romania’s GDP increased by a real 6.5% y/y in the first quarter of the year (Q1), according to the flash estimate published by the statistics office INS on May 17. The seasonally-adjusted quarterly GDP increased by 5.2% q/q compared to Q4, after a revised (from negative) 1.0% q/q advance posted in the last quarter of 2021.

INS’s flash estimate came as a surprise to independent analysts, who, based on the high energy prices and the effects of the war in Ukraine, included among their scenarios a technical recession episode in the first part of the year. Surprisingly, the energy prices may have actually been responsible for the stronger GDP in Q1 thanks to the strong growth of the leading petrochemical companies.

Poland’s GDP expands 9.1% y/y in Q1, brightening outlook for the year

Polish GDP expanded a seasonally adjusted 9.1% y/y in the first quarter, picking up from a gain of 8% y/y in the preceding three months, the Central Statistical Office (GUS) said in a flash estimate on May 17.

Robust growth is still the ripple effect of very solid activity in the second half of 2021 and puts Polish economy on a path to an expansion of even 5% in the entire 2022, analysts say.

Hungary’s core inflation gallops into double-digit territory

Headline inflation in Hungary accelerated to 9.5% y/y in April, from 8.5%, while core inflation edged up from 9.1% to 10.3%, according to data from the Central Statistics Office (KSH). In a month-on-month comparison, CPI was 1.6%, well above the 1.3% consensus, the highest rate of growth since 2012, when the government hiked VAT from 25% to 27%, the highest in Europe.

The April CPI figure overshot the central bank’s 9% forecast for April. In a monthly analysis released after the publication of the KSH data, the MNB said the increase in headline inflation was mainly driven by higher prices for core inflation items. Vehicle fuel prices contributed 1.4 pp to CPI.

Poland GDP (seasonally adjusted), change y/y

Source: GUS

CPI (y/y, pc)

www.bne.eu